Question: A Developer is proposing to build a new mixed-use project in Downtown Detroit. The Developer is seeking an incentive investment from the City of Detroit

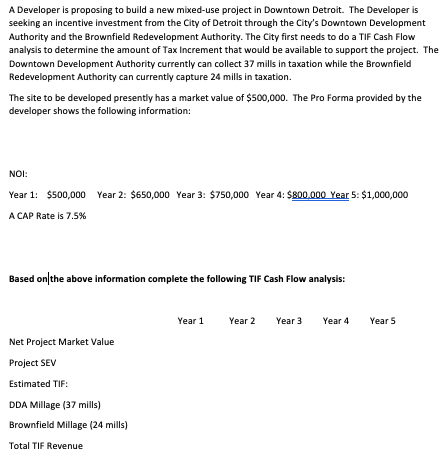

A Developer is proposing to build a new mixed-use project in Downtown Detroit. The Developer is seeking an incentive investment from the City of Detroit through the City's Downtown Development Authority and the Brownfield Redevelopment Authority. The City first needs to do a TIF Cash Flow analysis to determine the amount of Tax Increment that woulbable to support the project. The Downtown Development Authority currently can collect 37 mills in taxation while the Brownfield Redevelopment Authority can currently capture 24 mills in taxation. The site to be developed presently has a market value of $500,000. The Pro Forma provided by the developer shows the following information: NOI: Year 1: $500,000 A CAP Rate is 7.5% Year 2: $650,000 Year 3: $750,000 Year 4: $800,000 Year 5: $1,000,000 Based on the above information complete the following TIF Cash Flow analysis: Year 1 Year2 Year 3 Year 4 Year 5 Net Project Market Value Project SEV Estimated TIF DDA Millage (37 mills) Brownfield Millage (24 mills) Total TIF Revenue A Developer is proposing to build a new mixed-use project in Downtown Detroit. The Developer is seeking an incentive investment from the City of Detroit through the City's Downtown Development Authority and the Brownfield Redevelopment Authority. The City first needs to do a TIF Cash Flow analysis to determine the amount of Tax Increment that woulbable to support the project. The Downtown Development Authority currently can collect 37 mills in taxation while the Brownfield Redevelopment Authority can currently capture 24 mills in taxation. The site to be developed presently has a market value of $500,000. The Pro Forma provided by the developer shows the following information: NOI: Year 1: $500,000 A CAP Rate is 7.5% Year 2: $650,000 Year 3: $750,000 Year 4: $800,000 Year 5: $1,000,000 Based on the above information complete the following TIF Cash Flow analysis: Year 1 Year2 Year 3 Year 4 Year 5 Net Project Market Value Project SEV Estimated TIF DDA Millage (37 mills) Brownfield Millage (24 mills) Total TIF Revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts