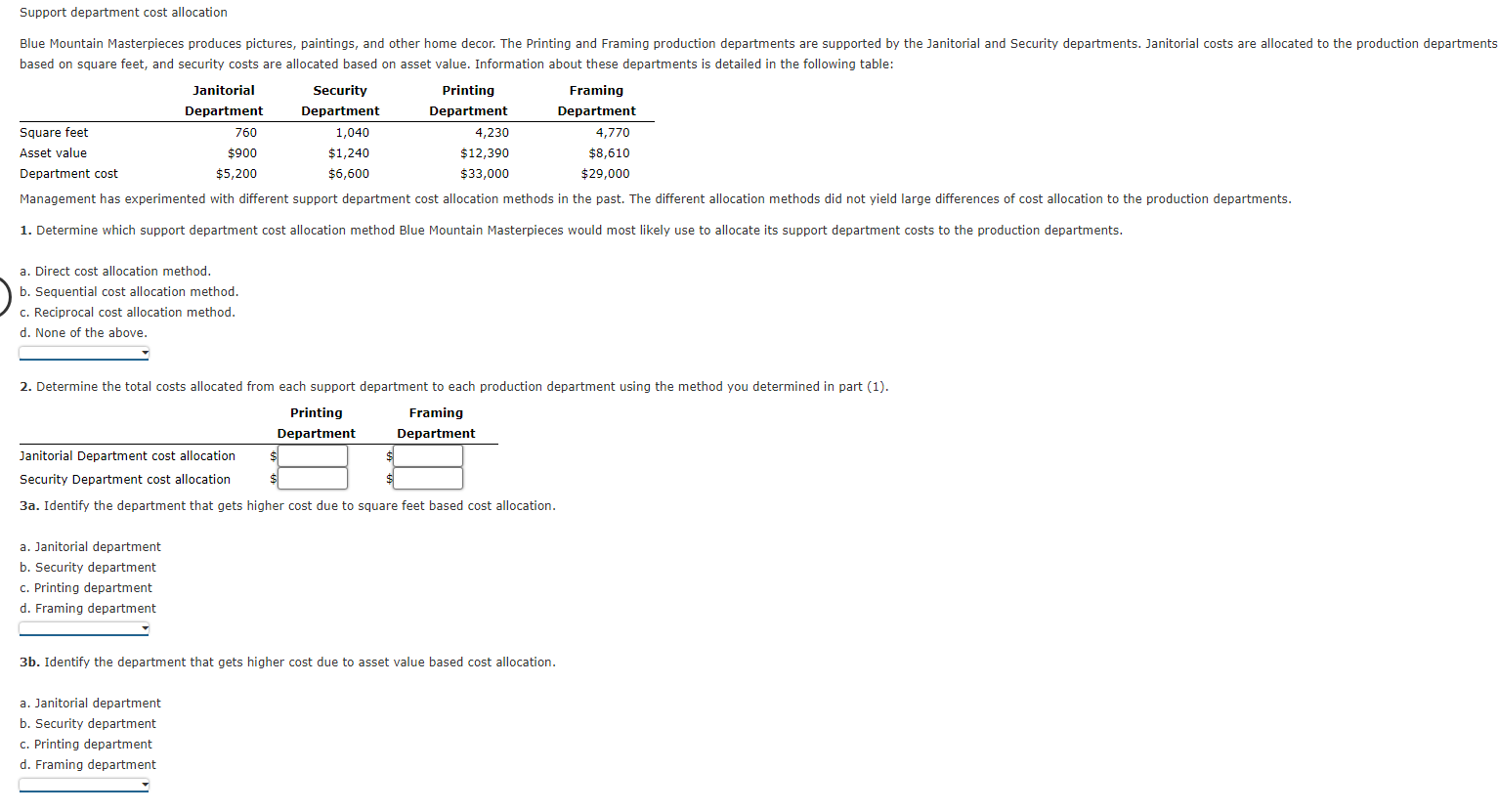

Question: a. Direct cost allocation method. b. Sequential cost allocation method. c. Reciprocal cost allocation method. d. None of the ahove. 2. Determine the total costs

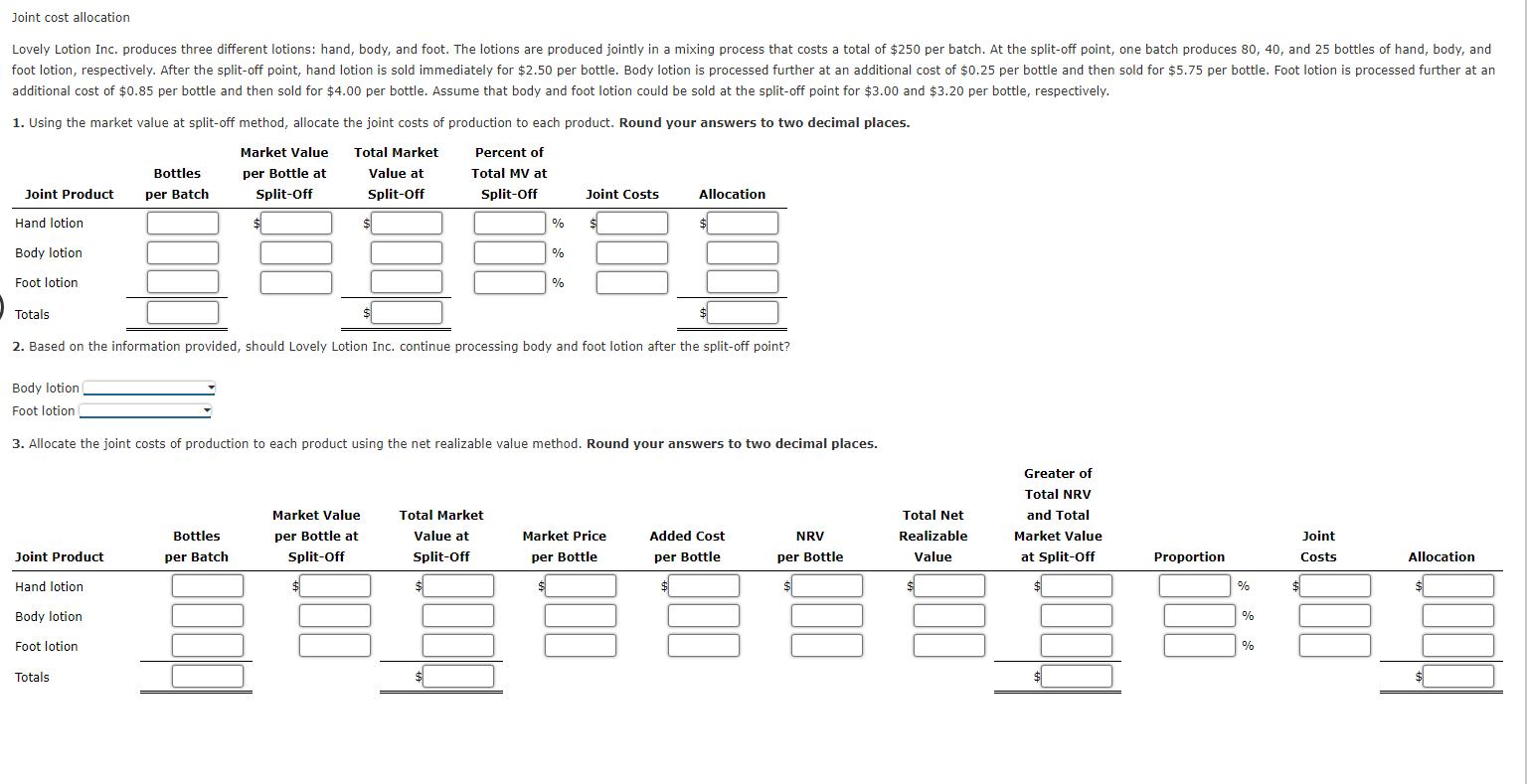

a. Direct cost allocation method. b. Sequential cost allocation method. c. Reciprocal cost allocation method. d. None of the ahove. 2. Determine the total costs allocated from each support department to each production depa 3a. Identify the department that gets higher cost due to square feet based cost allocation. a. Janitorial department b. Security department c. Printing department d. Framing department 3b. Identify the department that gets higher cost due to asset value based cost allocation. a. Janitorial department b. Security department c. Printing department d. Framing department Joint cost allocation additional cost of $0.85 per bottle and then sold for $4.00 per bottle. Assume that body and foot lotion could be sold at the split-off point for $3.00 and $3.20 per bottle, respectively. 1. Using the market value at split-off method, allocate the joint costs of production to each product. Round your answers to two decimal places. 2. Based on the information provided, should Lovely Lotion Inc. continue processing body and foot lotion after the split-off point? Body lotion Foot lotion 3. Allocate the joint costs of production to each product using the net realizable value method. Round your answers to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts