Question: A DIRECT MATERIALS budget will need to be produced for each ingredient used to make the milk shakes. The direct materials budget for whole milk

A DIRECT MATERIALS budget will need to be produced for each ingredient used to make the milk shakes. The direct materials budget for whole milk was prepared using the following assumptions:

- 10% of next months expected milk needs are desired to be left in ending inventory as a safety cushion.

- Remember, beginning inventory is last months ending inventory.

- Cost of whole milk was determined to be $0.02344 per ounce

| Milk Purchases Budget 1st quarter | |||||

|

|

|

|

|

|

|

| Large Milk Shake Production |

|

|

|

|

|

| Milk required per shake (ounces) |

|

|

|

|

|

| Ounces Needed for Large Milk Shake Production |

|

|

|

|

|

| Small Milk Shake Production |

|

|

|

|

|

| Milk required per shake (ounces) |

|

|

|

|

|

| Ounces needed for Small Milk Shake Production |

|

|

|

|

|

| Total Ounces Required for Production |

|

|

|

|

|

| Plus: Desired ending Inventory |

|

|

|

|

|

| Total Ounces Available |

|

|

|

|

|

| Less: Beginning Inventory |

|

|

|

|

|

| Total Ounces to be Purchased |

|

|

|

|

|

| Cost per Ounce |

|

|

|

|

|

| Total Cost of Milk to be Purchased |

|

|

|

|

|

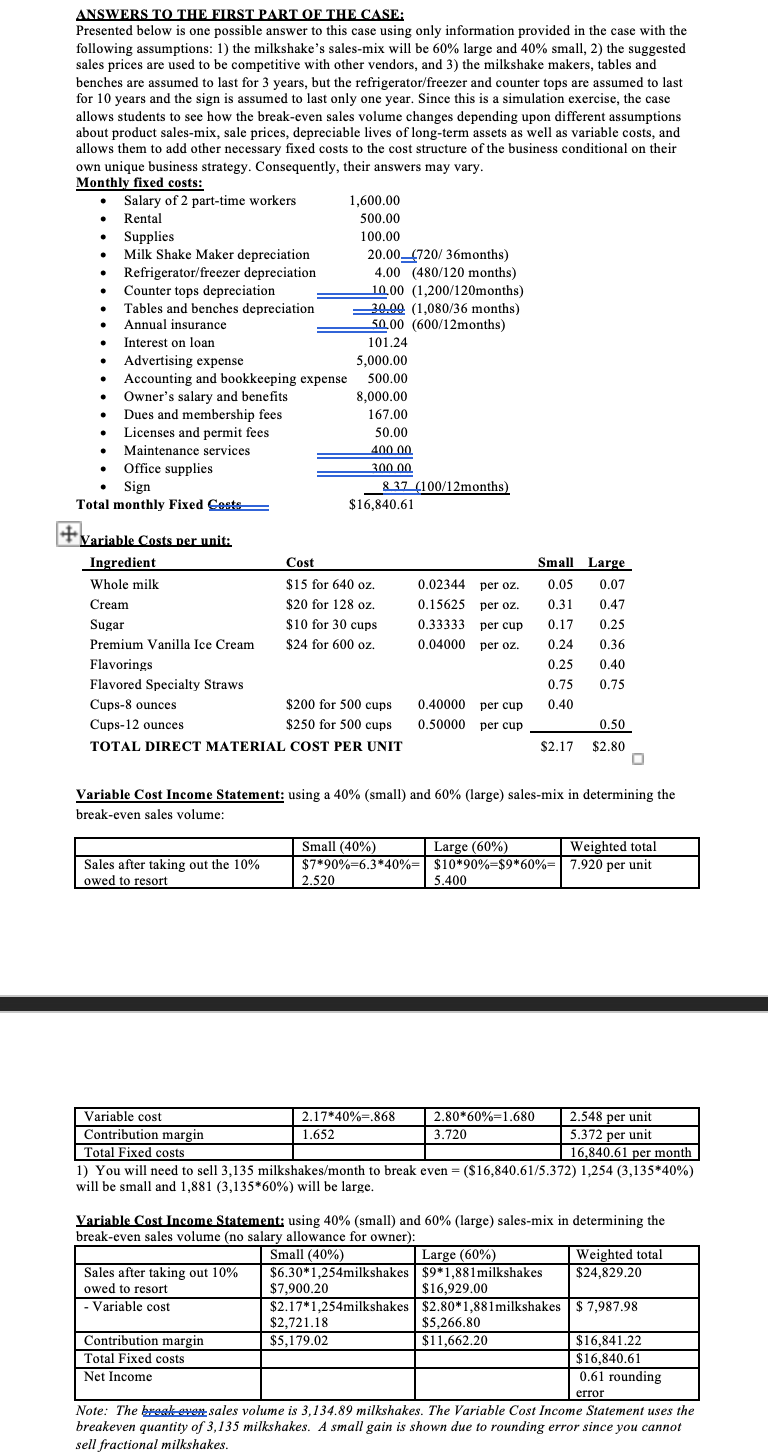

. ANSWERS TO THE FIRST PART OF THE CASE: Presented below is one possible answer to this case using only information provided in the case with the following assumptions: 1) the milkshake's sales-mix will be 60% large and 40% small, 2) the suggested sales prices are used to be competitive with other vendors, and the milkshake makers, tables and benches are assumed to last for 3 years, but the refrigerator/freezer and counter tops are assumed to last for 10 years and the sign is assumed to last only one year. Since this is a simulation exercise, the case allows students to see how the break-even sales volume changes depending upon different assumptions about product sales-mix, sale prices, depreciable lives of long-term assets as well as variable costs, and allows them to add other necessary fixed costs to the cost structure of the business conditional on their own unique business strategy. Consequently, their answers may vary. Monthly fixed costs: Salary of 2 part-time workers 1,600.00 Rental 500.00 Supplies 100.00 Milk Shake Maker depreciation 20.00_720/36months) Refrigerator/freezer depreciation 4.00 (480/120 months) Counter tops depreciation 10.00 (1,200/120months) Tables and benches depreciation 20.00 (1,080/36 months) Annual insurance 50.00 (600/12months) Interest on loan 101.24 Advertising expense 5,000.00 Accounting and bookkeeping expense 500.00 Owner's salary and benefits 8,000.00 Dues and membership fees 167.00 Licenses and permit fees 50.00 Maintenance services 400.00 Office supplies 300.00 Sign 837_4100/12months) Total monthly Fixed Costs $16,840.61 +Variable Costs per unit: Ingredient Cost Whole milk $15 for 640 oz. Cream $20 for 128 oz. Sugar $10 for 30 cups Premium Vanilla Ice Cream $24 for 600 oz. Flavorings Flavored Specialty Straws Cups-8 ounces $200 for 500 cups Cups-12 ounces $250 for 500 cups TOTAL DIRECT MATERIAL COST PER UNIT 0.02344 per oz. 0.15625 per oz. 0.33333 per cup 0.04000 per oz. Small Large 0.05 0.07 0.31 0.47 0.17 0.25 0.36 0.25 0.40 0.75 0.40 0.24 0.75 0.40000 per cup 0.50000 per cup 0.50 $2.17 $2.80 Variable Cost Income Statement: using a 40% (small) and 60% (large) sales-mix in determining the break-even sales volume: Small (40%) $7*90%=6.3*40% 2.520 Sales after taking out the 10% owed to resort Large (60%) $10*90%-$9*60%= 5.400 Weighted total 7.920 per unit Variable cost 2.17*40%=.868 2.80*60%=1.680 2.548 per unit Contribution margin 1.652 3.720 5.372 per unit Total Fixed costs 16,840.61 per month 1) You will need to sell 3,135 milkshakes/month to break even = ($16,840.61/5.372) 1,254 (3,135*40%) will be small and 1,881 (3,135*60%) will be large. Variable Cost Income Statement: using 40% (small) and 60% (large) sales-mix in determining the break-even sales volume (no salary allowance for owner): Small (40%) Large (60%) Weighted total Sales after taking out 10% $6.30*1,254milkshakes $9*1,881 milkshakes $24,829.20 owed to resort $7,900.20 $ 16,929.00 - Variable cost $2.17*1,254milkshakes $2.80*1,881milkshakes $ 7,987.98 $2.721.18 $5,266.80 Contribution margin $5,179.02 $11,662.20 $16,841.22 Total Fixed costs $16,840.61 Net Income 0.61 rounding error Note: The break even sales volume is 3,134.89 milkshakes. The Variable Cost Income Statement uses the breakeven quantity of 3,135 milkshakes. A small gain is shown due to rounding error since you cannot sell fractional milkshakes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts