Question: a . Disaggregate and document the activity for the 1 0 0 % Acquisition Accounting Premium ( AAP ) , the controlling interest AAP and

a Disaggregate and document the activity for the Acquisition Accounting Premium AAP the controlling interest AAP and the noncontrolling interest AAP.

Note: Do not use negative signs with any of your answers below.

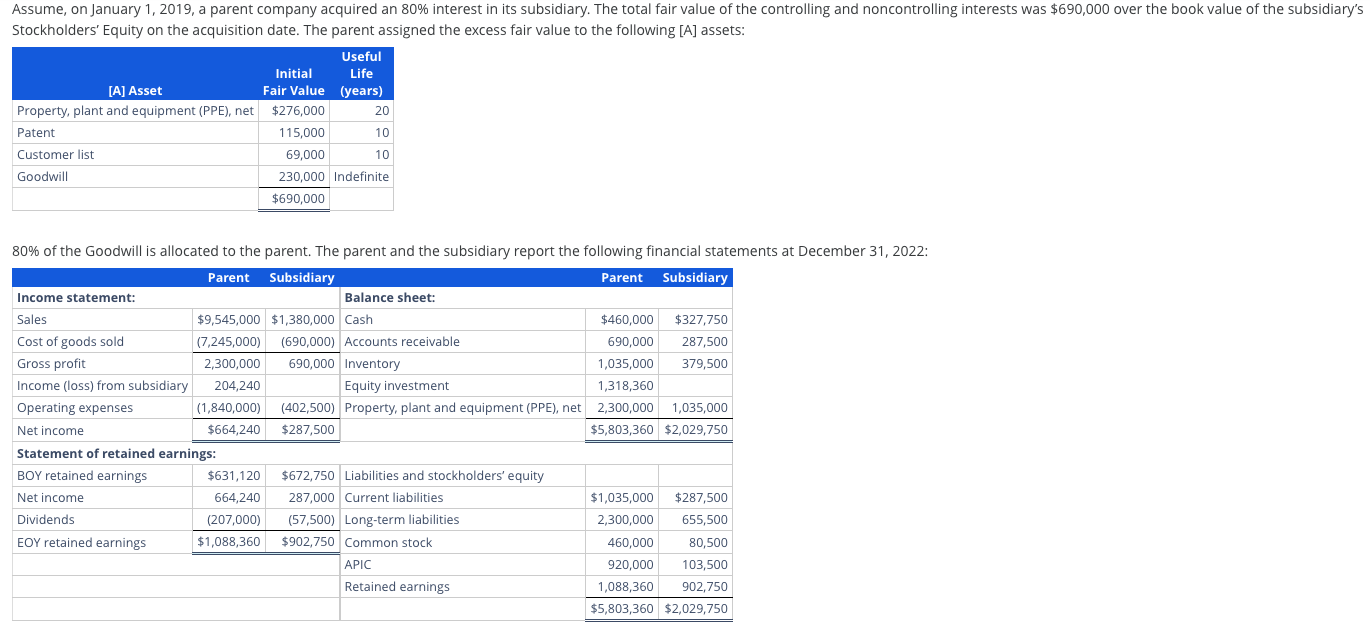

b Calculate and organize the profits and losses on intercompany transactions and balances.Assume, on January a parent company acquired an interest in its subsidiary. The total fair value of the controlling and noncontrolling interests was $ over the book value of the subsiary's

Stockholders' Equity on the acquisition date. The parent assigned the excess fair value to the following A assets:

of the Goodwill is allocated to the parent. The parent and the subsidiary report the following financial statements at December :

a Disaggregate and document the activity for the Acquisition Accounting Premium AAP the controlling interest AAP and the noncontrolling interest AAP.

Note: Do not use negative signs with any of your answers below.

Unamortized Unamortized Unamortized Unamortized Unamortized

AAP AAP AAP AAP AAP

Amortization Amortization Amortization Amortization

AAP:

Property, plant and equipment PPE net Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Patent Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Customer list Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Goodwill Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Parent :

Property, plant and equipment PPE net Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Patent Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Customer list Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Goodwill Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Subsidiary :

Property, plant and equipment PPE net Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Patent Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Customer list Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Goodwill Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

b Calculate and organize the profits and losses on intercompany transactions and balances.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock