Question: a. Discuss the adjusted present value (APV), the flow to equity (FTE) and the weighted average cost of capital (WACC) methods of capital budgeting with

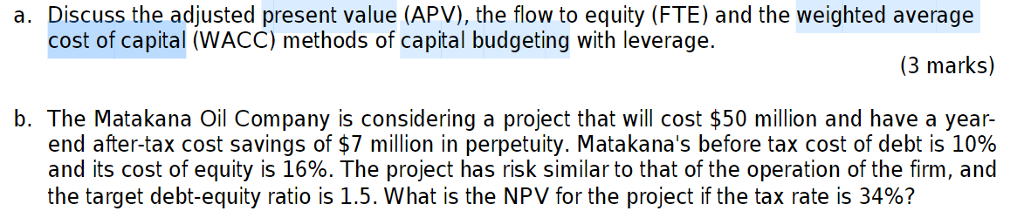

a. Discuss the adjusted present value (APV), the flow to equity (FTE) and the weighted average cost of capital (WACC) methods of capital budgeting with leverage. (3 marks) b. The Matakana Oil Company is considering a project that will cost $50 million and have a year- end after-tax cost savings of $7 million in perpetuity. Matakana's before tax cost of debt is 10% and its cost of equity is 16%. The project has risk similar to that of the operation of the firm, and the target debt-equity ratio is 1.5. What is the NPV for the project if the tax rate is 34%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts