Question: A distribution from a tax - deferred, qualified plan was made payable to a plan participant. What strategy could the particlpant utilize if they want

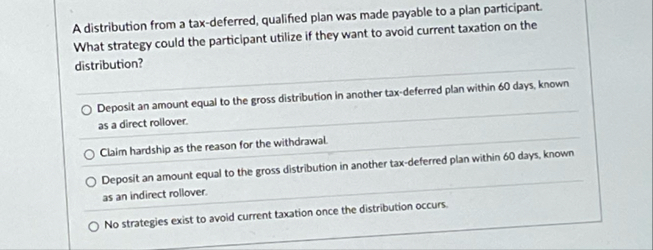

A distribution from a taxdeferred, qualified plan was made payable to a plan participant. What strategy could the particlpant utilize if they want to avoid current taxation on the distribution?

Deposit an amount equal to the gross distribution in another taxdeferred plan within days, known as a direct rollover.

Claim hardship as the reason for the withdrawal.

Deposit an amount equal to the gross distribution in another taxdeferred plan within days, known as an indirect rollover.

No strategies exist to avoid current taxation once the distribution occurs.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock