Question: A) Dividend preference theory (bird-in-the-hand theory) Despite some theoretical assertions, many investors do care a great deal about dividends. They believe that sure dividends today

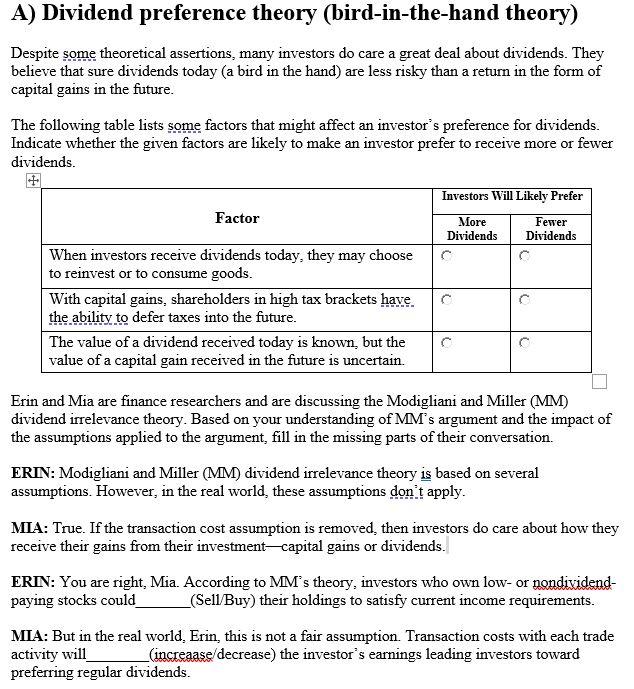

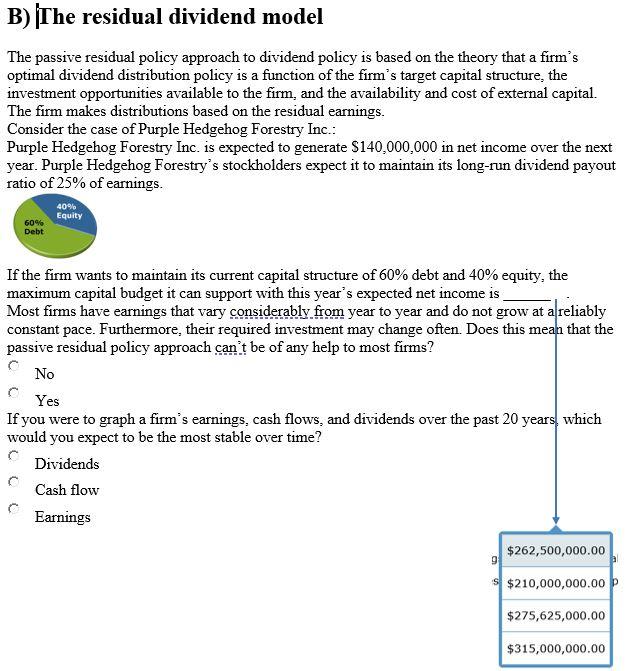

A) Dividend preference theory (bird-in-the-hand theory) Despite some theoretical assertions, many investors do care a great deal about dividends. They believe that sure dividends today ( a bird in the hand) are less risky than a return in the form of capital gains in the future. The following table lists some factors that might affect an investor's preference for dividends. Indicate whether the given factors are likely to make an investor prefer to receive more or fewer dividends. Erin and Mia are finance researchers and are discussing the Modigliani and Miller (MM) dividend irrelevance theory. Based on your understanding of MM's argument and the impact of the assumptions applied to the argument, fill in the missing parts of their conversation. ERIN: Modigliani and Miller (MM) dividend irrelevance theory is based on several assumptions. However, in the real world, these assumptions don.t apply. MIA: True. If the transaction cost assumption is removed, then investors do care about how they receive their gains from their investment - capital gains or dividends. ERIN: You are right, Mia. According to MM's theory, investors who own low- or nondividendpaying stocks could (Sell/Buy) their holdings to satisfy current income requirements. MIA: But in the real world, Erin, this is not a fair assumption. Transaction costs with each trade activity will (increaase/decrease) the investor's earnings leading investors toward preferring regular dividends. The passive residual policy approach to dividend policy is based on the theory that a firm's optimal dividend distribution policy is a function of the firm's target capital structure, the investment opportunities available to the firm, and the availability and cost of external capital. The firm makes distributions based on the residual earnings. Consider the case of Purple Hedgehog Forestry Inc.: Purple Hedgehog Forestry Inc. is expected to generate $140,000,000 in net income over the next year. Purple Hedgehog Forestry's stockholders expect it to maintain its long-run dividend payout ratio of 25% of earnings. If the firm wants to maintain its current capital structure of 60% debt and 40% equity, the maximum capital budget it can support with this year's expected net income is Most firms have earnings that vary considerably from year to year and do not grow at a reliably constant pace. Furthermore, their required investment may change often. Does this mean that the passive residual policy approach can't be of any help to most firms? No Yes If you were to graph a firm's earnings, cash flows, and dividends over the past 20 years which would you expect to be the most stable over time? Dividends Cash flow Earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts