Question: a. Do nothing, which will leave the key financial variables unchanged. b. Invest in a new machine that will increase the dividend growth rate to

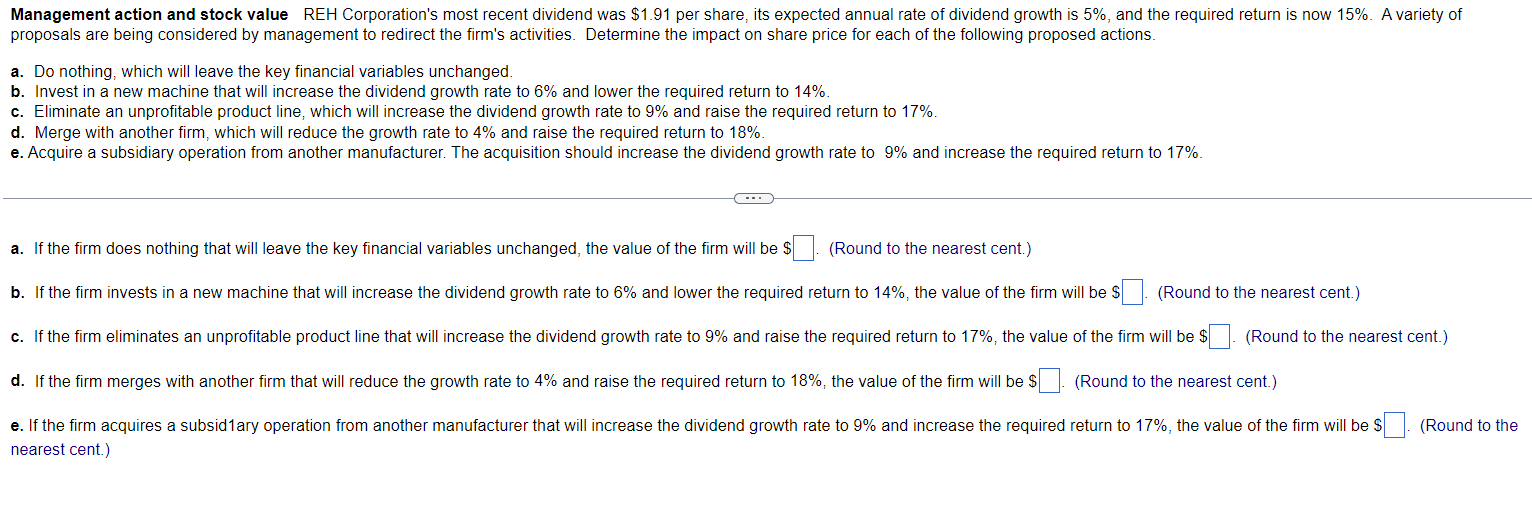

a. Do nothing, which will leave the key financial variables unchanged. b. Invest in a new machine that will increase the dividend growth rate to 6% and lower the required return to 14%. c. Eliminate an unprofitable product line, which will increase the dividend growth rate to 9% and raise the required return to 17%. d. Merge with another firm, which will reduce the growth rate to 4% and raise the required return to 18%. e. Acquire a subsidiary operation from another manufacturer. The acquisition should increase the dividend growth rate to 9% and increase the required return to 17%. a. If the firm does nothing that will leave the key financial variables unchanged, the value of the firm will be $. (Round to the nearest cent.) d. If the firm merges with another firm that will reduce the growth rate to 4% and raise the required return to 18%, the value of the firm will be (Round to the nearest cent.) nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts