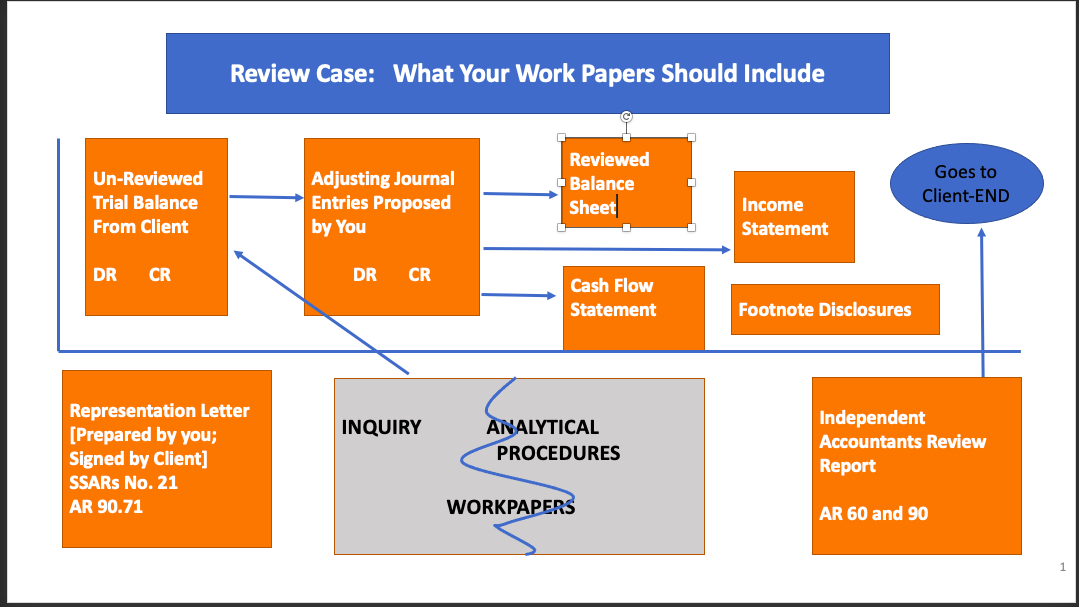

Question: a. Document in your workpapers, the inquiries and proposed adjusting journal entries resulting from your analytical procedures to bring Oceanview Marine Company into compliance with

a. Document in your workpapers, the inquiries and proposed adjusting journal entries resulting from your analytical procedures to bring Oceanview Marine Company into compliance with GAAP, from your limited Review.

b. Prepare work papers to support your Review Report. (Use the flowchart provided to make sure you include everything needed.)

| OCEANVIEW MARINE COMPANY | |||||||

| TRIAL BALANCE | % Change from 2020 | ||||||

| AS OF DECEMBER 31, 2021 | As of December 31,2021 | As of December 31, 2020 | to 2021 | ||||

| Account | Description | UNREVIEWED Trial Balance | REVIEWED TRIAL BALANCE | ||||

| 1010 | Petty Cash | -$200 | -$200 | 0.00% | |||

| 1015 | Bank-Payroll | -$2,000 | -$2,000 | 0.00% | |||

| 1020 | Bank-General | -$13,17,896 | -$10,89,978 | 20.91% | |||

| 1100 | Accounts receivable | -$17,62,682 | -$14,02,229 | 25.71% | |||

| 1110 | Allowance for bad debts | $1,16,636 | $1,16,636 | 0.00% | |||

| 1205 | Inventory-boats | -$1,31,67,170 | -$1,20,30,247 | 9.45% | |||

| 1210 | Inventory-repair parts | -$2,00,390 | -$1,82,983 | 9.51% | |||

| 1215 | Inventory-supplies | -$1,56,789 | -$1,43,170 | 9.51% | |||

| 1300 | Prepaid expenses | -$17,720 | -$15,826 | 11.97% | |||

| 1400 | Deposits | -$7,916 | -$5,484 | 44.35% | |||

| 1500 | Land | -$1,00,000 | -$1,00,000 | 0.00% | |||

| 1510 | Automobiles | -$42,772 | -$42,772 | 0.00% | |||

| 1511 | Accum.deprec.-automobiles | $31,865 | -$10,907 | $29,000 | -$13,772 | 9.88% | |

| 1520 | Equipment | -$1,34,919 | -$1,32,900 | 1.52% | |||

| 1521 | Accum.deprec.-equipment | $51,452 | -$83,467 | $49,000 | -$83,900 | 5.00% | |

| 1530 | Office equipment | -$49,028 | -$46,700 | 4.99% | |||

| 1531 | Accum.deprec.-officeequip. | $23,737 | -$25,291 | $21,230 | -$25,470 | 11.81% | |

| 1540 | Building | -$5,25,840 | -$5,25,840 | 0.00% | |||

| 1541 | Accum.deprec.-building | $1,48,988 | -$3,76,852 | $1,50,000 | -$3,75,840 | -0.67% | |

| 1550 | Docks | -$21,000 | -$21,000 | 0.00% | |||

| 1551 | Accum.deprec.-docks | $21,000 | $0 | $21,000 | $0 | 0.00% | |

| $0 | |||||||

| 2010 | Accounts payable-trade | $17,50,831 | $14,03,247 | 24.77% | |||

| 2100 | Wages and salaries payable | $1,82,360 | $1,75,000 | 4.21% | |||

| 2110 | Payroll withholdings payable | $42,972 | $37,000 | 16.14% | |||

| 2200 | Federal income taxes payable | $35,284 | $45,990 | -23.28% | |||

| 2300 | Interest payable | $32,468 | $34,000 | -4.51% | |||

| 2400 | Notes payable-bank | $51,00,000 | $41,50,000 | 22.89% | |||

| 2500 | L.T.debt-current portion | $5,642 | $5,642 | 0.00% | |||

| 2710 | Long-term debt | $4,09,824 | $4,15,466 | -1.36% | |||

| 3100 | Common stock | $10,000 | $10,000 | 0.00% | |||

| 3200 | Additional paid-in capital | $25,00,000 | $25,00,000 | 0.00% | |||

| 3500 | Retained earnings-Beginning | $65,18,413 | $61,95,636 | 5.21% | |||

| 3510 | Dividends paid | -$1,00,000 | -$1,00,000 | 0.00% | |||

| 4100 | Sales revenue | $2,63,56,647 | $2,28,89,060 | 15.15% | |||

| 4500 | Sales returns and allowances | -$37,557 | -$27,740 | 35.39% | |||

| 5100 | Cost of goods sold | -$1,91,33,299 | -$1,65,30,114 | 15.75% | |||

| 6010 | Accounting fees | -$48,253 | -$46,750 | 3.21% | |||

| 6020 | Advertising | -$28,624 | -$25,000 | 14.50% | |||

| 6050 | Depreciation | -$46,415 | -$46,578 | -0.35% | |||

| 6100 | Bad debts | -$1,48,252 | -$1,62,344 | -8.68% | |||

| 6120 | Business publications | -$1,231 | -$872 | 41.17% | |||

| 6240 | Cleaning service | -$15,817 | -$12,809 | 23.48% | |||

| 653 | Fuel | -$64,161 | -$53,566 | 19.78% | |||

| 6810 | Garbage collection | -$6,870 | -$4,674 | 46.98% | |||

| 6820 | Insurance | -$16,415 | -$16,303 | 0.69% | |||

| 6830 | Interest Expense | -$4,27,362 | -$3,64,312 | 17.31% | |||

| 7110 | Legal | -$73,000 | -$34,914 | 109.09% | |||

| 7130 | Licensing & certification fees | -$33,580 | -$27,142 | 23.72% | |||

| 7150 | Linen service | -$3,044 | -$1,939 | 56.99% | |||

| 7230 | Miscellaneous | -$47,254 | -$15,689 | 201.19% | |||

| 7420 | Office supplies | -$26,390 | -$23,289 | 13.32% | |||

| 7560 | Postage | -$8,623 | -$20,962 | -58.86% | |||

| 7580 | Property taxes | -$3,978 | -$27,946 | -85.77% | |||

| 7620 | Rent-warehouse | -$1,58,526 | -$1,20,000 | 32.11% | |||

| 7630 | Repairs and maintenance | -$51,316 | -$26,439 | 94.09% | |||

| 7710 | Security | -$1,54,000 | -$1,01,098 | 52.33% | |||

| 7810 | Telephone | -$5,707 | -$7,092 | -19.53% | |||

| 7850 | Travel & entertainment | -$21,633 | -$16,303 | 32.69% | |||

| 7980 | Utilities | -$63,329 | -$43,919 | 44.19% | |||

| 9100 | Salaries-management | -$4,01,809 | -$3,70,000 | 8.60% | |||

| 9110 | Salaries-office | -$55,512 | -$53,000 | 4.74% | |||

| 9120 | Salaries-sales | -$26,60,806 | -$23,94,800 | 11.11% | |||

| 9200 | Wages-Mechanics | -$2,64,583 | -$2,60,583 | 1.54% | |||

| 9210 | Wages-Rental | -$1,00,312 | -$1,05,300 | -4.74% | |||

| 9220 | Wages-warehouse | -$8,27,259 | -$8,18,000 | 1.13% | |||

| 9500 | Payroll benefits | -$5,69,110 | -$4,61,214 | 23.39% | |||

| 9600 | Medical benefits | -$7,000 | -$4,624 | 51.38% | |||

| 9610 | Pension expense | -$40,770 | -$37,263 | 9.41% | |||

| 9900 | Income tax expense | -$1,80,000 | -$1,44,000 | 25.00% | |||

| Control Totals | $0 | $0 | |||||

| Net Income | $6,24,850 | $4,82,482 | 29.51% | ||||

| The accompanying notes form an integral part of these financial statements. | |||||||

| SEE SHEET 2 (Disclosures) for Notes to the Financial Statements | |||||||

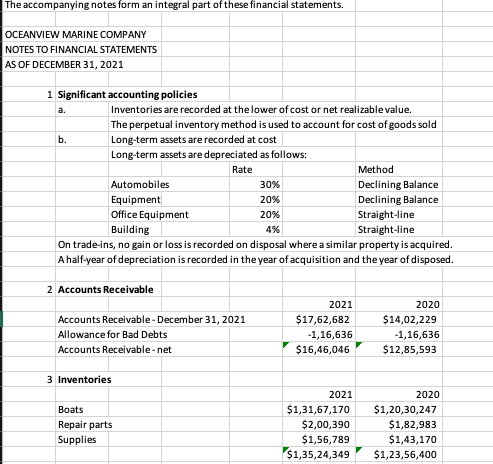

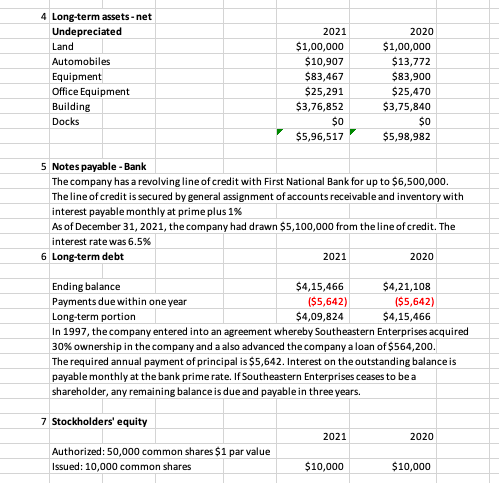

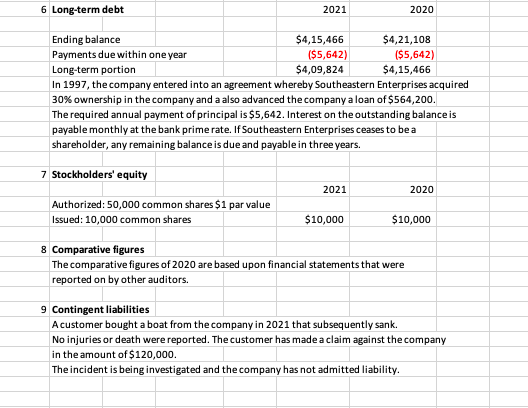

The accompanying notes form an integral part of these financial statements. OCEANVIEW MARINE COMPANY NOTES TO FINANCIAL STATEMENTS AS OF DECEMBER 31, 2021 1 Significant accounting policies a. Inventories are recorded at the lower of cost or net realizable value. The perpetual inventory method is used to account for cost of goods sold b. \begin{tabular}{|l|r|l|} \hline \multicolumn{2}{|l|}{ Long-term assets are recorded at cost } & \\ \hline Long-term assets are depreciated as follows: & \\ \hline & Rate & Method \\ \hline Automobiles & 30% & Declining Balance \\ \hline Equipment & 20% & Declining Balance \\ \hline Office Equipment & 20% & Straight-line \\ \hline Building & 4% & Straight-line \\ \hline \end{tabular} On trade-ins, no gain or loss is recorded on disposal where a similar property is acquired. A half-year of depreciation is recorded in the year of acquisition and the year of disposed. 2 Accounts Receivable Review Case: What Your Work Papers Should Include 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts