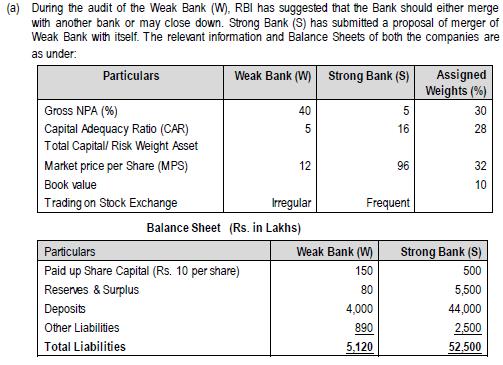

(a) During the audit of the Weak Bank (W), RBI has suggested that the Bank should...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

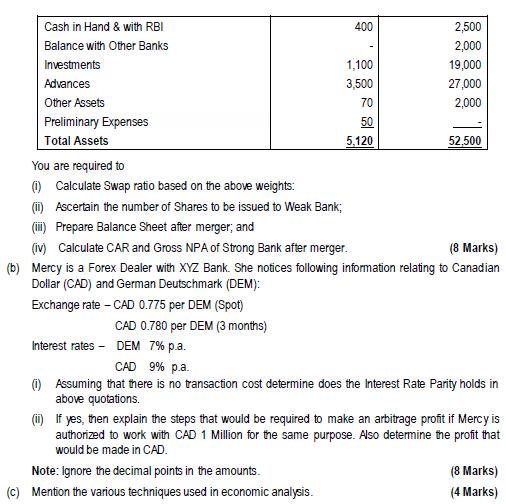

(a) During the audit of the Weak Bank (W), RBI has suggested that the Bank should either merge with another bank or may close down. Strong Bank (S) has submitted a proposal of merger of Weak Bank with itself. The relevant information and Balance Sheets of both the companies are as under: Particulars Gross NPA (%) Capital Adequacy Ratio (CAR) Total Capital/ Risk Weight Asset Weak Bank (W) Strong Bank (S) 56 40 5 16 Assigned Weights (%) 30 28 Market price per Share (MPS) Book value 12 96 200 32 10 Trading on Stock Exchange Irregular Frequent Balance Sheet (Rs. in Lakhs) Particulars Weak Bank (W) Strong Bank (S) Paid up Share Capital (Rs. 10 per share) 150 500 Reserves & Surplus 80 5,500 Deposits 4,000 44,000 Other Liabilities Total Liabilities 890 2,500 5,120 52,500 Cash in Hand & with RBI 400 2,500 Balance with Other Banks 2,000 Investments 1,100 19,000 Advances 3,500 27,000 Other Assets 70 2,000 Preliminary Expenses 50 Total Assets 5,120 52,500 You are required to (i) Calculate Swap ratio based on the above weights: (ii) Ascertain the number of Shares to be issued to Weak Bank; (iii) Prepare Balance Sheet after merger; and (iv) Calculate CAR and Gross NPA of Strong Bank after merger. (8 Marks) (b) Mercy is a Forex Dealer with XYZ Bank. She notices following information relating to Canadian Dollar (CAD) and German Deutschmark (DEM): Exchange rate - CAD 0.775 per DEM (Spot) CAD 0.780 per DEM (3 months) Interest rates DEM 7% p.a. CAD 9% p.a. (i) Assuming that there is no transaction cost determine does the Interest Rate Parity holds in above quotations. (ii) If yes, then explain the steps that would be required to make an arbitrage profit if Mercy is authorized to work with CAD 1 Million for the same purpose. Also determine the profit that would be made in CAD. Note: Ignore the decimal points in the amounts. (c) Mention the various techniques used in economic analysis. (8 Marks) (4 Marks) (a) During the audit of the Weak Bank (W), RBI has suggested that the Bank should either merge with another bank or may close down. Strong Bank (S) has submitted a proposal of merger of Weak Bank with itself. The relevant information and Balance Sheets of both the companies are as under: Particulars Gross NPA (%) Capital Adequacy Ratio (CAR) Total Capital/ Risk Weight Asset Weak Bank (W) Strong Bank (S) 56 40 5 16 Assigned Weights (%) 30 28 Market price per Share (MPS) Book value 12 96 200 32 10 Trading on Stock Exchange Irregular Frequent Balance Sheet (Rs. in Lakhs) Particulars Weak Bank (W) Strong Bank (S) Paid up Share Capital (Rs. 10 per share) 150 500 Reserves & Surplus 80 5,500 Deposits 4,000 44,000 Other Liabilities Total Liabilities 890 2,500 5,120 52,500 Cash in Hand & with RBI 400 2,500 Balance with Other Banks 2,000 Investments 1,100 19,000 Advances 3,500 27,000 Other Assets 70 2,000 Preliminary Expenses 50 Total Assets 5,120 52,500 You are required to (i) Calculate Swap ratio based on the above weights: (ii) Ascertain the number of Shares to be issued to Weak Bank; (iii) Prepare Balance Sheet after merger; and (iv) Calculate CAR and Gross NPA of Strong Bank after merger. (8 Marks) (b) Mercy is a Forex Dealer with XYZ Bank. She notices following information relating to Canadian Dollar (CAD) and German Deutschmark (DEM): Exchange rate - CAD 0.775 per DEM (Spot) CAD 0.780 per DEM (3 months) Interest rates DEM 7% p.a. CAD 9% p.a. (i) Assuming that there is no transaction cost determine does the Interest Rate Parity holds in above quotations. (ii) If yes, then explain the steps that would be required to make an arbitrage profit if Mercy is authorized to work with CAD 1 Million for the same purpose. Also determine the profit that would be made in CAD. Note: Ignore the decimal points in the amounts. (c) Mention the various techniques used in economic analysis. (8 Marks) (4 Marks)

Expert Answer:

Answer rating: 100% (QA)

a 1 Calculate Swap ratio based on the above weights Weak Bank W total capital 150 capital 80 reserves surplus 230 Lakhs Strong Bank S total capital 44... View the full answer

Related Book For

Posted Date:

Students also viewed these finance questions

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Brist Ltd is a UK resident company which prepares annual accounts to 31 March. In the year to 31 March 2021, the company had a UK trading profit of 2,120,000 and received overseas property income of...

-

Using the rules found in this chapter, give systematic names for the following or indicate that more rules need to be provided: (a) (b) (c) (d) Cl CI H C-B Br Br

-

The Filling Department of Ivy Cosmetics Company had 6,000 ounces in beginning work in process inventory (60% complete). During the period, 68,000 ounces were completed. The ending work in process...

-

Consider the two treatment assignment mechanisms (7.1) and (7.2). What is the probability \(P\left(T_{i}=1 ight)\) in each case? What is \(P\left(T_{i}=1 \mid Y_{i}(0)> ight.\) \(\left.Y_{i}(1)...

-

We-Rescue-Dogs Kennel had a labor cost budget of $ 100,000 for the year. It expected its staff costs related to grooming, feeding, walking, and so on to vary in direct proportion with the number of...

-

Saturna Corporation began Year 6 with the following account balances: Common shares, 1 0 0 , 0 0 0 shares authorized, 5 0 , 0 0 0 issued $ 1 , 2 0 0 , 0 0 0 Retained earnings 9 5 0 , 0 0 0 During...

-

Calculate the Forward premium(discount) for the EUR/USD using the direct rate. Calculate the Forward premium (discount) fot the GBP/USD using the indirect rate. Calculate the EUR/GBP rate.

-

What is the reason that some taxpayers are not entitled to the standard deduction or are entitled to only part of it? Explain.

-

Distinguish between compensation and gifts and identify the tax consequence associated with each.

-

Identify and discuss three situations in which a partner recognizes gain (income) or loss on the receipt of an interest in partnership capital and profits.

-

How are S corporations taxed by states?

-

Define a Type C reorganization and explain its unique requirements.

-

Select a Leader: Steve jobs. How did your leader display (or not display) aspects of Communication and Leadership. Recognizing and Leveraging Organizational Culture and Climate, and Developing High...

-

Using Apple, demonstrate how the differentiation strategy can be well implemented.

-

Identify each of the following as a consumer product or a business product, or classify it as both: a. frozen yogurt b. iPad c. gasoline d. boat trailer e. hand sanitizer f. Post-its

-

What are the steps in developing a marketing strategy?

-

What is the difference between primary data and secondary data?

Study smarter with the SolutionInn App