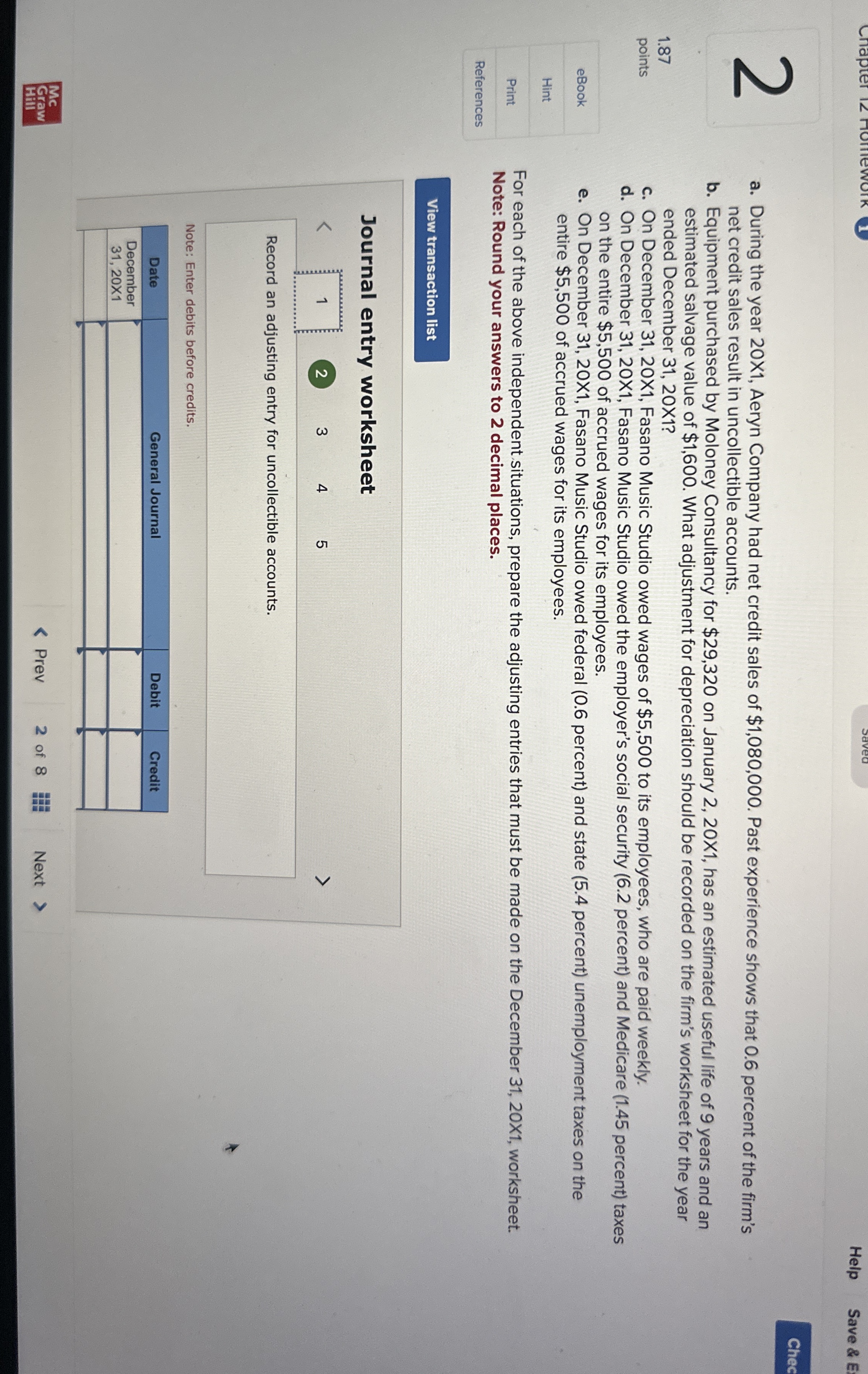

Question: a . During the year 2 0 X 1 , Aeryn Company had net credit sales of $ 1 , 0 8 0 , 0

a During the year X Aeryn Company had net credit sales of $ Past experience shows that percent of the firm's

net credit sales result in uncollectible accounts.

b Equipment purchased by Moloney Consultancy for $ on January X has an estimated useful life of years and an

estimated salvage value of $ What adjustment for depreciation should be recorded on the firm's worksheet for the year

ended December X

c On December X Fasano Music Studio owed wages of $ to its employees, who are paid weekly.

d On December times Fasano Music Studio owed the employer's social security percent and Medicare percent taxes

on the entire $ of accrued wages for its employees.

e On December X Fasano Music Studio owed federal percent and state percent unemployment taxes on the

entire $ of accrued wages for its employees.

For each of the above independent situations, prepare the adjusting entries that must be made on the December X worksheet.

Note: Round your answers to decimal places.

Journal entry worksheet

Record an adjusting entry for uncollectible accounts.

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock