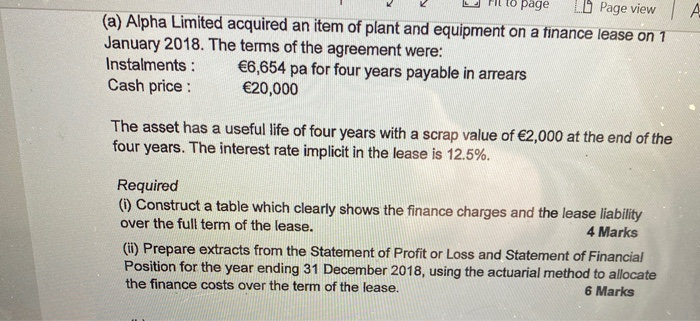

Question: A e puye LU Page view (a) Alpha Limited acquired an item of plant and equipment on a finance lease on 1 January 2018. The

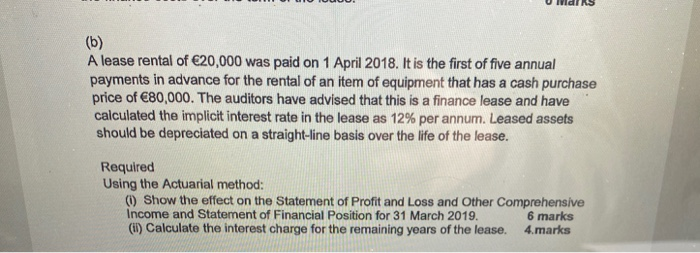

A e puye LU Page view (a) Alpha Limited acquired an item of plant and equipment on a finance lease on 1 January 2018. The terms of the agreement were: Instalments: 6,654 pa for four years payable in arrears Cash price: 20,000 The asset has a useful life of four years with a scrap value of 2,000 at the end of the four years. The interest rate implicit in the lease is 12.5%. Required (1) Construct a table which clearly shows the finance charges and the lease liability over the full term of the lease. 4 Marks (1) Prepare extracts from the Statement of Profit or Loss and Statement of Financial Position for the year ending 31 December 2018, using the actuarial method to allocate the finance costs over the term of the lease. 6 Marks (b) A lease rental of 20,000 was paid on 1 April 2018. It is the first of five annual payments in advance for the rental of an item of equipment that has a cash purchase price of 80,000. The auditors have advised that this is a finance lease and have calculated the implicit interest rate in the lease as 12% per annum. Leased assets should be depreciated on a straight-line basis over the life of the lease. Required Using the Actuarial method: () Show the effect on the Statement of Profit and Loss and Other Comprehensive Income and Statement of Financial Position for 31 March 2019. 6 marks (1) Calculate the interest charge for the remaining years of the lease. 4.marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts