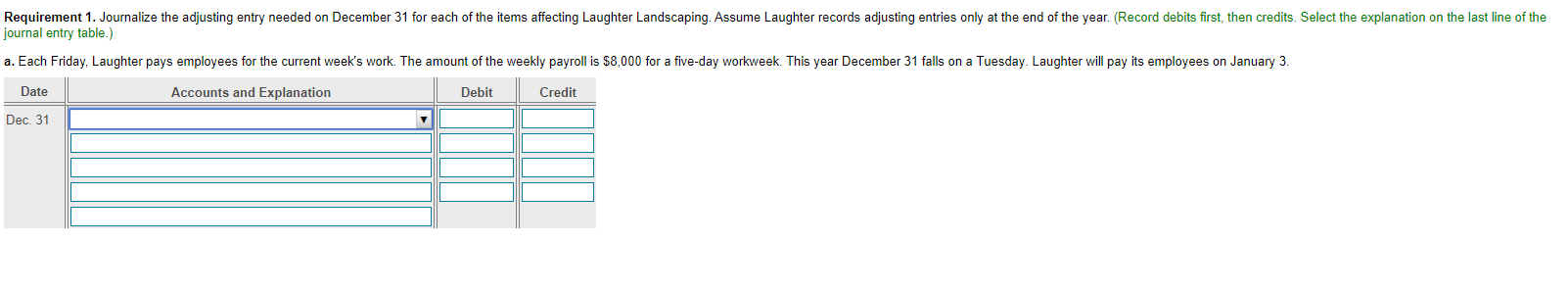

Question: a. Each Friday, Laughter pays employees for the current week's work. The amount of the weekly payroll is $8,000 for a five-day workweek. This year

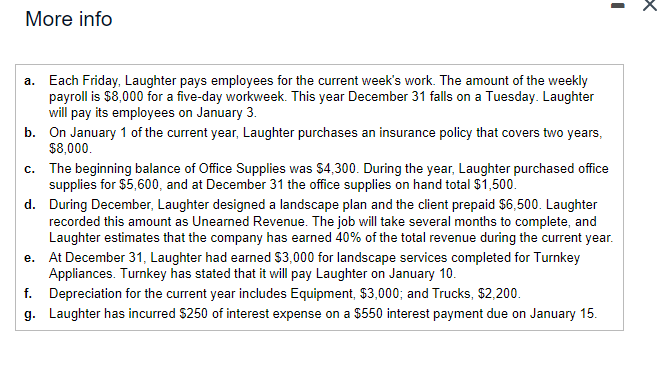

a. Each Friday, Laughter pays employees for the current week's work. The amount of the weekly payroll is $8,000 for a five-day workweek. This year December 31 falls on a Tuesday. Laughter will pay its employees on January 3. b. On January 1 of the current year, Laughter purchases an insurance policy that covers two years, $8,000. c. The beginning balance of Office Supplies was $4,300. During the year, Laughter purchased office supplies for $5,600, and at December 31 the office supplies on hand total $1,500. d. During December, Laughter designed a landscape plan and the client prepaid $6,500. Laughter recorded this amount as Unearned Revenue. The job will take several months to complete, and Laughter estimates that the company has earned 40% of the total revenue during the current year. e. At December 31, Laughter had earned $3,000 for landscape services completed for Turnkey Appliances. Turnkey has stated that it will pay Laughter on January 10. f. Depreciation for the current year includes Equipment, $3,000; and Trucks, $2,200. g. Laughter has incurred $250 of interest expense on a $550 interest payment due on January 15 . a. Each Friday, Laughter pays employees for the current week's work. The amount of the weekly payroll is $8,000 for a five-day workweek. This year December 31 falls on a Tuesday. Laughter will pay its employees on January 3. b. On January 1 of the current year, Laughter purchases an insurance policy that covers two years, $8,000. c. The beginning balance of Office Supplies was $4,300. During the year, Laughter purchased office supplies for $5,600, and at December 31 the office supplies on hand total $1,500. d. During December, Laughter designed a landscape plan and the client prepaid $6,500. Laughter recorded this amount as Unearned Revenue. The job will take several months to complete, and Laughter estimates that the company has earned 40% of the total revenue during the current year. e. At December 31, Laughter had earned $3,000 for landscape services completed for Turnkey Appliances. Turnkey has stated that it will pay Laughter on January 10. f. Depreciation for the current year includes Equipment, $3,000; and Trucks, $2,200. g. Laughter has incurred $250 of interest expense on a $550 interest payment due on January 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts