Question: A. Estimate a bid price (equity per share) based on DCF analysis B. Estimate a bid price based on comparable transactions Assumptions: ABC company

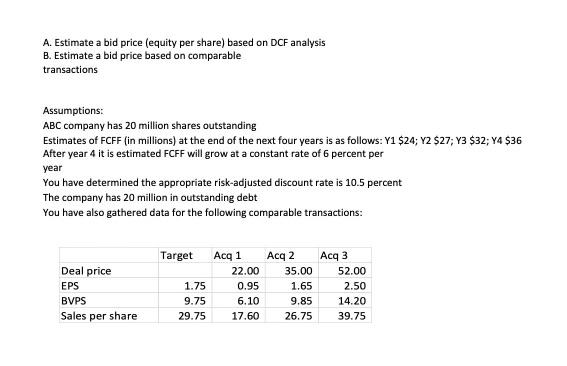

A. Estimate a bid price (equity per share) based on DCF analysis B. Estimate a bid price based on comparable transactions Assumptions: ABC company has 20 million shares outstanding Estimates of FCFF (in millions) at the end of the next four years is as follows: Y1 $24; Y2 $27; Y3 $32; Y4 $36 After year 4 it is estimated FCFF will grow at a constant rate of 6 percent per year You have determined the appropriate risk-adjusted discount rate is 10.5 percent The company has 20 million in outstanding debt You have also gathered data for the following comparable transactions: Deal price EPS BVPS Sales per share Target 1.75 9.75 29.75 Acq 1 Acq 2 22.00 35.00 0.95 1.65 6.10 9.85 17.60 26.75 Acq 3 52.00 2.50 14.20 39.75

Step by Step Solution

There are 3 Steps involved in it

Here are the estimated bid prices using DCF and comparable transactions ... View full answer

Get step-by-step solutions from verified subject matter experts