Question: (a) Evaluate these projects by using the mean-variance approach with the consideration of all the possible interest rate listed in Table 2. Show your calculation

(a) Evaluate these projects by using the mean-variance approach with the consideration of all the possible interest rate listed in Table 2. Show your calculation steps and final answers with four decimal places.

(b) Explain which project should be select based on the mean-variance approach analysis.

(c) Suppose the firm imposes a minimum profit threshold to be 0.18 million dollars, explain which project should be selected.

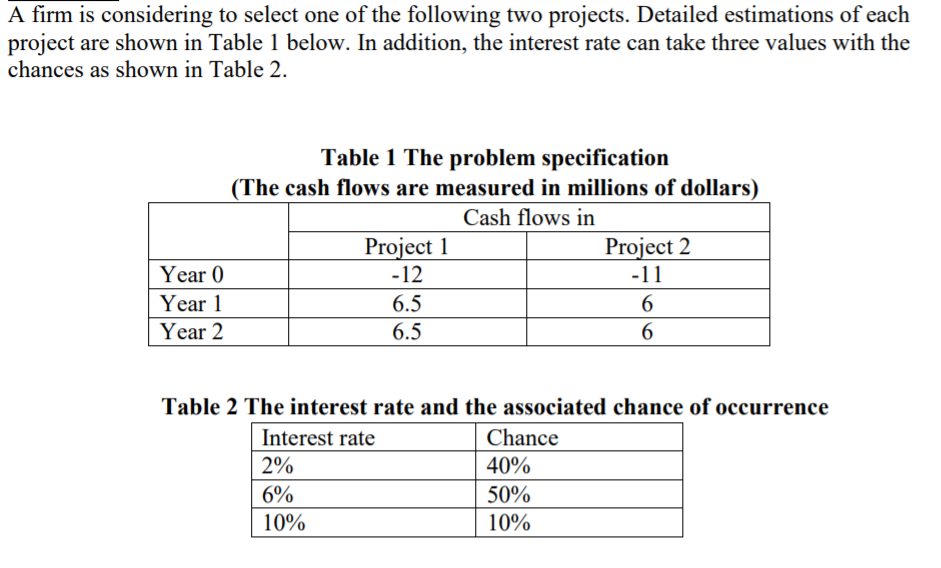

A firm is considering to select one of the following two projects. Detailed estimations of each project are shown in Table 1 below. In addition, the interest rate can take three values with the chances as shown in Table 2. Table 1 The problem specification (The cash flows are measured in millions of dollars) Cash flows in Project 1 Project 2 Year 0 -12 -11 Year 1 6.5 6 Year 2 6.5 6 Table 2 The interest rate and the associated chance of occurrence Interest rate Chance 2% 40% 6% 50% 10% 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts