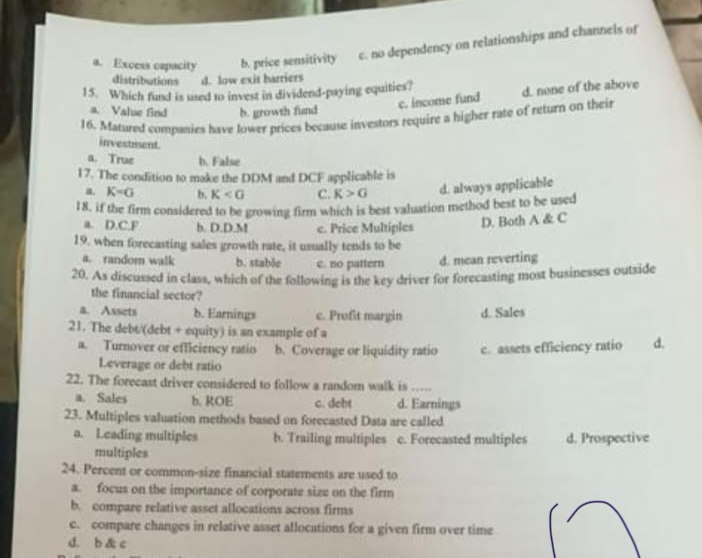

Question: a . Excess capacity b . grice sensitivity c . no dependency on relationships and channels of distributions 4 . low exir harriers 1 5

a Excess capacity

b grice sensitivity

c no dependency on relationships and channels of distributions

low exir harriers

which fund is utrd io inveat in dividendpryine cquities?

a Value find

b yrawth fiend

c income fund

d none of the above

Matured compunien have lower prices bocause invetors require a higher rate of return on their imvestment.

a True

b False

The condition so make the DDM and DCF applicable is

a

b

always applicable

the firm conaldered growing firm which best valuation method beat used

Price Multiples

Poth

when forecanting cales growth raic, unually tends

random walk

stable

pattern

mcan reverting

discusied class, which the following the key driver for forccasting most beskinesses outside the firancial sector?

Asets

Earnings

Profit inaryin

Sales

The equity example

Tumover efliciency ratio

Coverage liquidity ratio

astets efficiency ratio

leverage deht ratio

The forecant driver considerod follow a random walk

Sates

ROE

deht

Earnings

Multiples valuation methods besed ois forecasted Data are called

Lcading multiples

Trailing multiples

Forecasted multiples

Prospective multiples

Percent commonsiae financial italements are used

focus the importance corporate size the firm

compare relative asset allocations across firms

compare changes relative asset allocations for a given firm over time

bec

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock