Question: a) Exercise 1: What is the Responsibility Report variance for Direct Labor and is it Favorable (F) or Unfavorable (U)? See circle on the printed

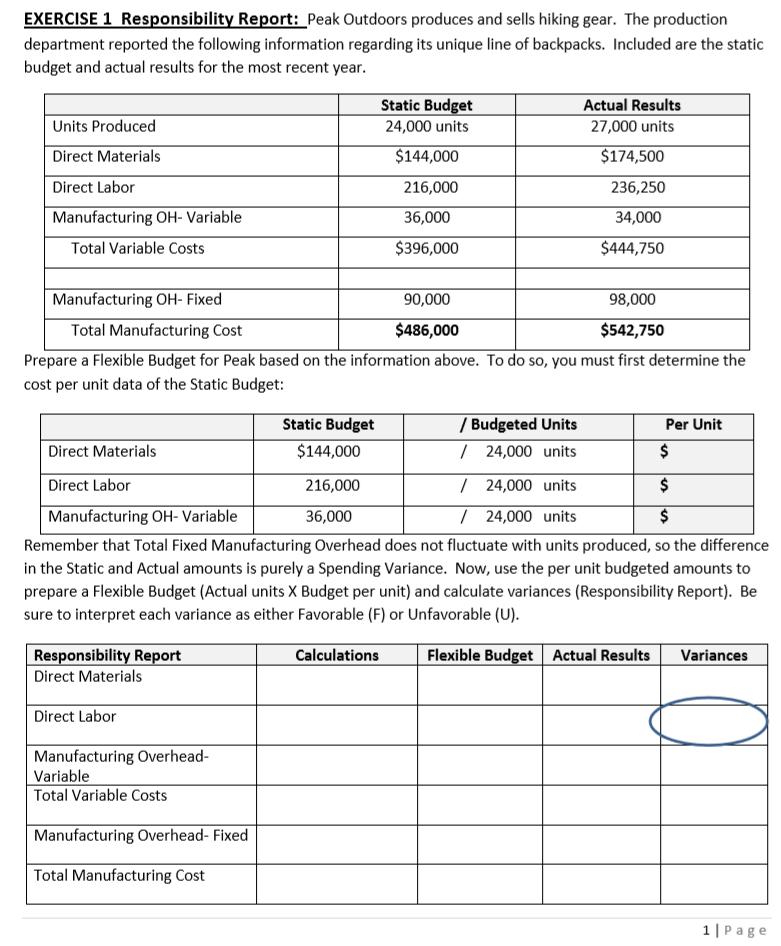

a) Exercise 1: What is the Responsibility Report variance for Direct Labor and is it Favorable (F) or Unfavorable (U)? See circle on the printed exercise. A complete answer must have both the dollar variance amount and the F or U designation.

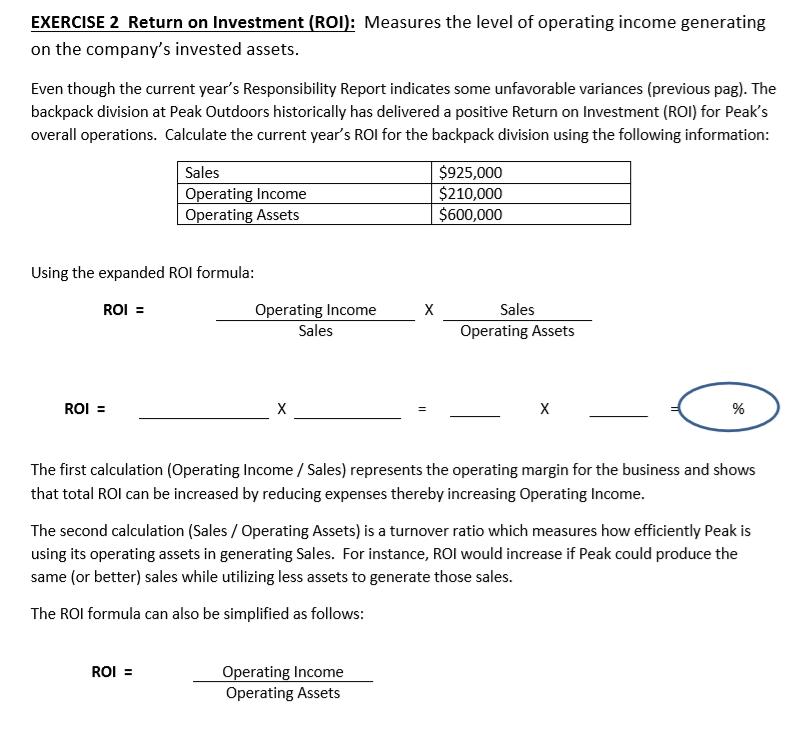

b) Exercise 2: What is the ROI calculation. Express your answer as a %.

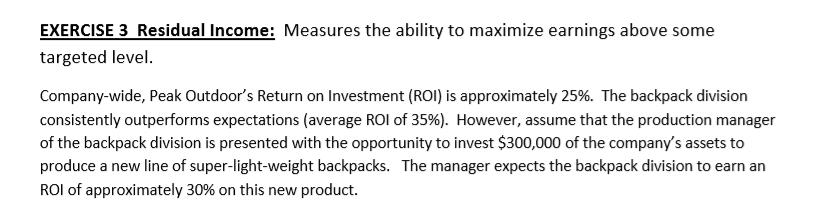

c) Exercise 3: What is the Residual Income for Backpack Division after investing the $300,000 and based on this should the division adopt the new line? A complete answer should include a $ amount and a Yes or No.

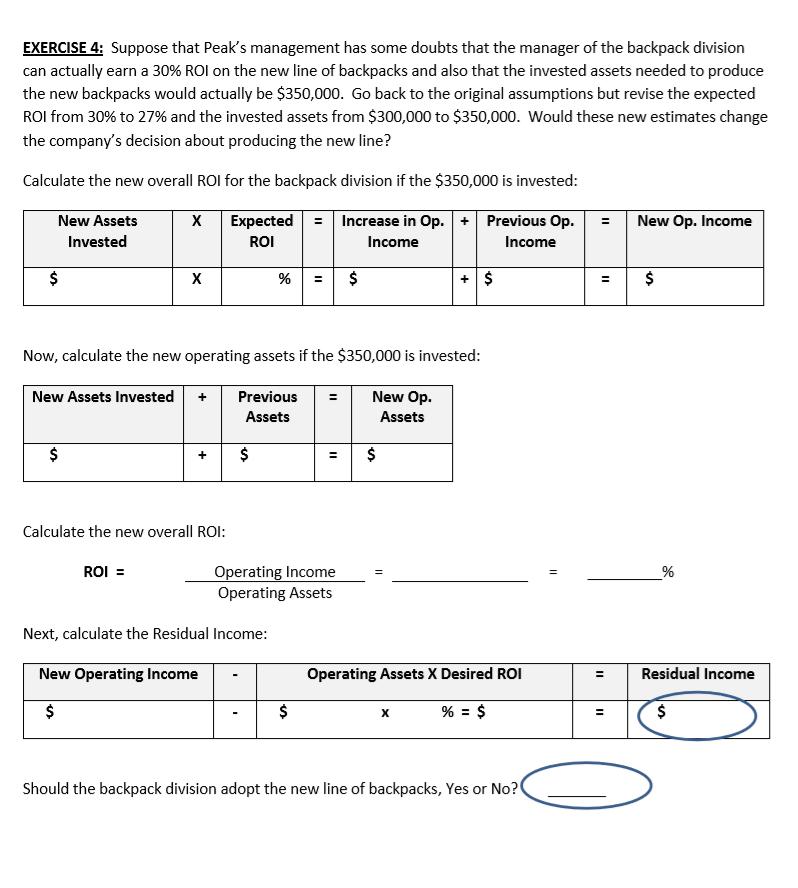

d) Exercise 4: What is the Residual Income for the Backpack Division given these new assumptions and based on this should the division adopt the new line? A complete answer should include a $ and a Yes or No.

EXERCISE 1 Responsibility Report: Peak Outdoors produces and sells hiking gear. The production department reported the following information regarding its unique line of backpacks. Included are the static budget and actual results for the most recent year. Units Produced Direct Materials Direct Labor Manufacturing OH- Variable Total Variable Costs Responsibility Report Direct Materials Direct Labor Static Budget 24,000 units Manufacturing OH- Fixed 98,000 Total Manufacturing Cost $542,750 Prepare a Flexible Budget for Peak based on the information above. To do so, you must first determine the cost per unit data of the Static Budget: Manufacturing Overhead- Variable Total Variable Costs $144,000 216,000 36,000 $396,000 Manufacturing Overhead- Fixed Total Manufacturing Cost 90,000 $486,000 Static Budget $144,000 Direct Materials Direct Labor 216,000 $ / 24,000 units / 24,000 units Manufacturing OH- Variable 36,000 $ Remember that Total Fixed Manufacturing Overhead does not fluctuate with units produced, so the difference in the Static and Actual amounts is purely a Spending Variance. Now, use the per unit budgeted amounts to prepare a Flexible Budget (Actual units X Budget per unit) and calculate variances (Responsibility Report). Be sure to interpret each variance as either Favorable (F) or Unfavorable (U). Calculations Flexible Budget Actual Results Actual Results 27,000 units / Budgeted Units / 24,000 units $174,500 236,250 34,000 $444,750 Per Unit $ Variances 1| Page

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

To calculate the Responsibility Report variance for Direct Labor and determine if it is Favorable F or Unfavorable U we need to follow these steps 1 Calculate the Direct Labor cost per unit in the Sta... View full answer

Get step-by-step solutions from verified subject matter experts