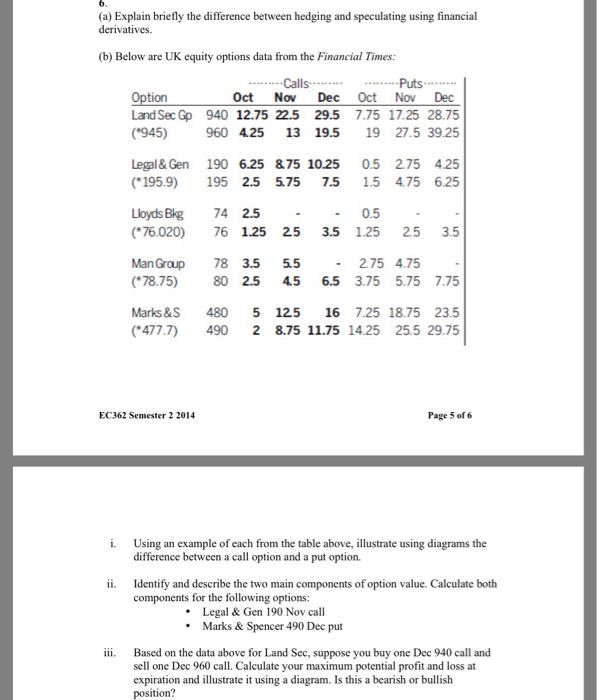

Question: (a) Explain briefly the difference between hedging and speculating using financial derivatives. (b) Below are UK equity options data from the Financial Times: Puts Oct

(a) Explain briefly the difference between hedging and speculating using financial derivatives. (b) Below are UK equity options data from the Financial Times: Puts Oct Nov Dec Oct Nov Dec tion Land Sec Gp 940 12.75 22.5 29.5 7.75 17.25 28.75 (945) 960 425 13 19.5 19 27.5 39.25 Legal& Gen 190 6.25 &75 10.25 0.5 275 4.25 195.9 195 2.5 5.75 7.5 1.5 475 6.25 Lloyds Bkg 74 2.5- 0.5 76.020) 76 1.25 25 3.5 1.25 25 3.5 ManGroup 78 3.5 55 (78.75) 802.5 45 6.5 3.75 5.75 7.75 Marks &S 480 5 125 16 7.25 18.75 23.5 477.7)490 2 8.75 11.75 14.25 25.5 29.75 275 4.75- EC362 Semester 2 2014 Page 5 of6 i. Using an example of each from the table above, illustrate using diagrams the difference between a call option and a put option. ii. Identify and describe the two main components of option value. Calculate both components for the following options: Legal&Gen 190 Nov call Marks &Spencer 490 Dec put iii. Based on the data above for Land Sec, suppose you buy one Dec 940 call and sell one Dec 960 call. Calculate your maximum potential profit and loss at expiration and illustrate it using a diagram. Is this a bearish or bullish position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts