Question: a) Explain how credit risk is transferred through securitization . ( 10 marks) b) All tranches in an ABS have the same risk exposure. Discuss

(10 marks)

(10 marks)

(10 marks)

(10 marks)

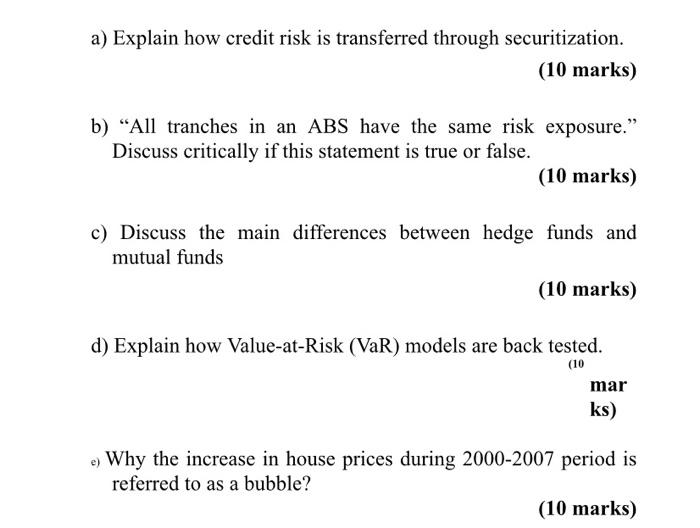

a) Explain how credit risk is transferred through securitization. (10 marks) b) All tranches in an ABS have the same risk exposure." Discuss critically if this statement is true or false. (10 marks) c) Discuss the main differences between hedge funds and mutual funds (10 marks) d) Explain how Value-at-Risk (VaR) models are back tested. (10 mar ks) e) Why the increase in house prices during 2000-2007 period is referred to as a bubble? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts