Question: (A) Explain implied volatility and how it is calculated. (5 marks) (B) A January call option with an exercise price of RM46 had a price

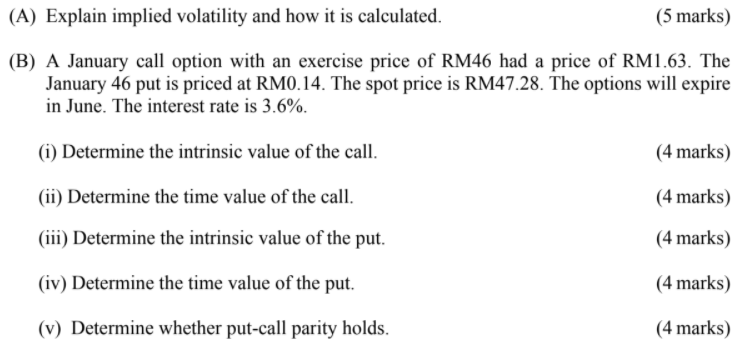

(A) Explain implied volatility and how it is calculated. (5 marks) (B) A January call option with an exercise price of RM46 had a price of RM1.63. The January 46 put is priced at RM0.14. The spot price is RM47.28. The options will expire in June. The interest rate is 3.6%. (i) Determine the intrinsic value of the call. (4 marks) (ii) Determine the time value of the call. (4 marks) (iii) Determine the intrinsic value of the put. (4 marks) (iv) Determine the time value of the put. (4 marks) (v) Determine whether put-call parity holds. (4 marks) (A) Explain implied volatility and how it is calculated. (5 marks) (B) A January call option with an exercise price of RM46 had a price of RM1.63. The January 46 put is priced at RM0.14. The spot price is RM47.28. The options will expire in June. The interest rate is 3.6%. (i) Determine the intrinsic value of the call. (4 marks) (ii) Determine the time value of the call. (4 marks) (iii) Determine the intrinsic value of the put. (4 marks) (iv) Determine the time value of the put. (4 marks) (v) Determine whether put-call parity holds. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts