Question: An investor has the choice of purchasing a 19-year annual bond, that has annual coupon payment of $70, each year plus its par-value in

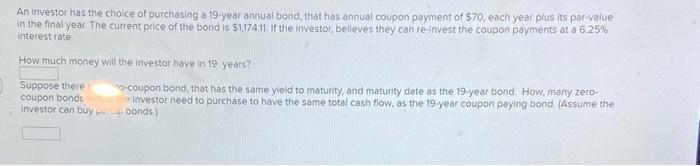

An investor has the choice of purchasing a 19-year annual bond, that has annual coupon payment of $70, each year plus its par-value in the final year. The current price of the bond is $1,174.11. If the investor, believes they can re-invest the coupon payments at a 6.25% interest rate How much money will the investor have in 19 years? Suppose there o-coupon bond, that has the same yield to maturity, and maturity date as the 19-year bond. How, many zero- coupon bonds Investor need to purchase to have the same total cash flow, as the 19-year coupon paying bond (Assume the investor can buy paral bonds)

Step by Step Solution

3.47 Rating (147 Votes )

There are 3 Steps involved in it

806 Criven Coupon C 70 Interest 2 625 Time n 19 ive EV Fu... View full answer

Get step-by-step solutions from verified subject matter experts