Question: (a) Explain the concept of Macaulay duration and explain why a coupon paying bond has a duration less than its maturity. (4 marks) (b) Calculate

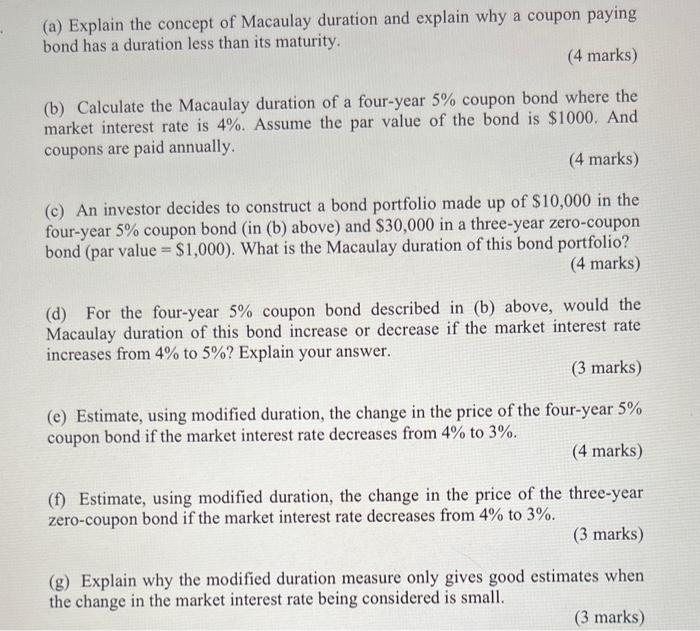

(a) Explain the concept of Macaulay duration and explain why a coupon paying bond has a duration less than its maturity. (4 marks) (b) Calculate the Macaulay duration of a four-year 5% coupon bond where the market interest rate is 4%. Assume the par value of the bond is $1000. And coupons are paid annually. (4 marks) (c) An investor decides to construct a bond portfolio made up of $10,000 in the four-year 5% coupon bond (in (b) above) and $30,000 in a three-year zero-coupon bond (par value =$1,000 ). What is the Macaulay duration of this bond portfolio? (4 marks) (d) For the four-year 5% coupon bond described in (b) above, would the Macaulay duration of this bond increase or decrease if the market interest rate increases from 4% to 5% ? Explain your answer. (3 marks) (e) Estimate, using modified duration, the change in the price of the four-year 5% coupon bond if the market interest rate decreases from 4% to 3%. (4 marks) (f) Estimate, using modified duration, the change in the price of the three-year zero-coupon bond if the market interest rate decreases from 4% to 3%. ( 3 marks) (g) Explain why the modified duration measure only gives good estimates when the change in the market interest rate being considered is small

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts