Question: a. Explain the difference between a traditional and an activity-based costing system. Type your answer here (2 marks) b. Bright Ltd runs two programs: engine

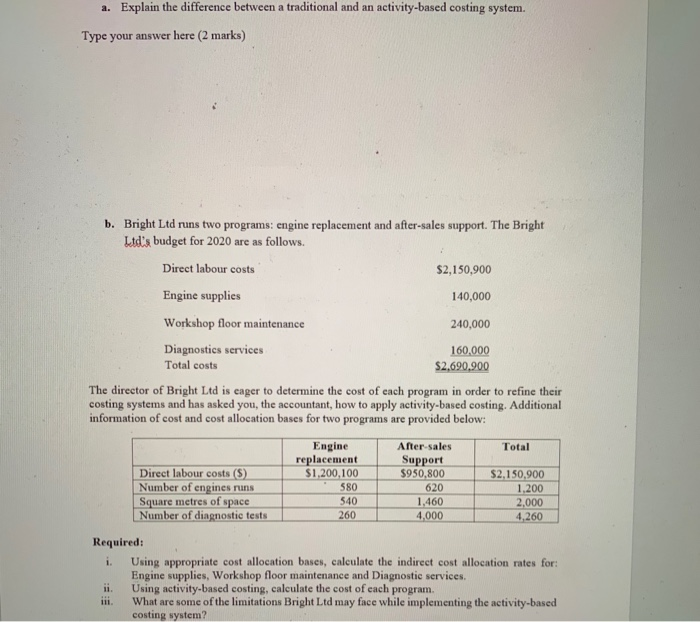

a. Explain the difference between a traditional and an activity-based costing system. Type your answer here (2 marks) b. Bright Ltd runs two programs: engine replacement and after-sales support. The Bright Ltd's budget for 2020 are as follows. Direct labour costs $2,150,900 Engine supplies 140,000 Workshop floor maintenance 240,000 Diagnostics services 160,000 Total costs $2,690.900 The director of Bright Ltd is eager to determine the cost of each program in order to refine their costing systems and has asked you, the accountant, how to apply activity-based costing. Additional information of cost and cost allocation bases for two programs are provided below: 620 Engine After-sales Total replacement Support Direct labour costs (5) $1,200,100 $950.800 $2,150,900 Number of engines ruins 580 1,200 Square metres of space 540 1.460 2,000 Number of diagnostic tests 260 4,000 4,260 Required: i. Using appropriate cost allocation bases, calculate the indirect cost allocation rates for: Engine supplies, Workshop floor maintenance and Diagnostic services, ii. Using activity-based costing, calculate the cost of each program. What are some of the limitations Bright Ltd may face while implementing the activity-based costing system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts