Question: (a) Explain what are the consequences of the model. (b) Write down the partial likelihood based on the dataset given in Table 2. (c) Derive

(a) Explain what are the consequences of the model.

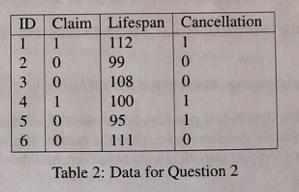

(b) Write down the partial likelihood based on the dataset given in Table 2.

(c) Derive the score function and observed Fisher information for B.

(d) Calculate the maximum partial likelihood estimator B of the effect of the claim to the cancellation of the insurance contract.

(e) Determine the estimated variance of the estimator B.

(f) State appropriate null and alternative hypotheses, Ho and Hi, to test the significance of the effect of a claim on the cancellation of the insurance contract.

(g) State your conclusions about the null hypothesis at a significance level of a = 5% using both the likelihood ratio statistic and the Z-score.

In the Bonus-Malus system, car-insurance premiums are adjusted if the customer has ever made a claim in the past. The increase in the premium may affect the cancellation of the insurance contract. The data below records the lifespan of insurance contracts until their cancellation is observed. Claim 1 if there is a claim made; Cancellation = 1 if the contract is cancelled.

Consider the Cox proportional model (t|x) = 2o(t)ex for given covariate x. We want to study the effect of a claim on the cancellation of the insurance contract.

Lifespan ID Claim 1 1 112 0 99 0 108 1 100 0 95 0 111 Table 2: Data for Question 2 Cancellation 345623 1 0 0 1 1 0

Step by Step Solution

3.42 Rating (174 Votes )

There are 3 Steps involved in it

a The consequences of this model are that the hazard rate of cancellation is proportional to a baseline hazard and to a covariate effect expB This cov... View full answer

Get step-by-step solutions from verified subject matter experts