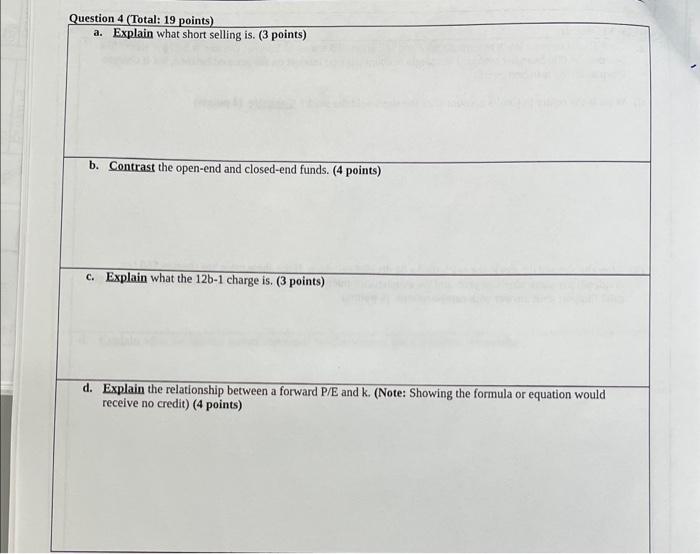

Question: a. Explain what short selling is. (3 points) b. Contrast the open-end and closed-end funds. (4 points) c. Explain what the 12b-1 charge is. (3

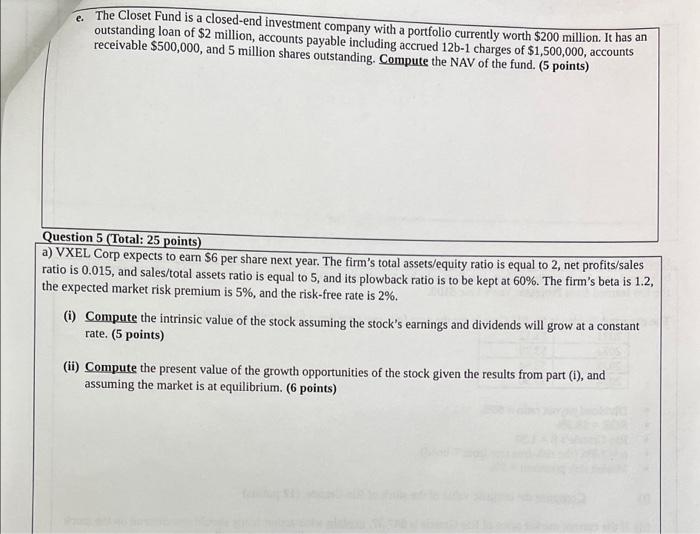

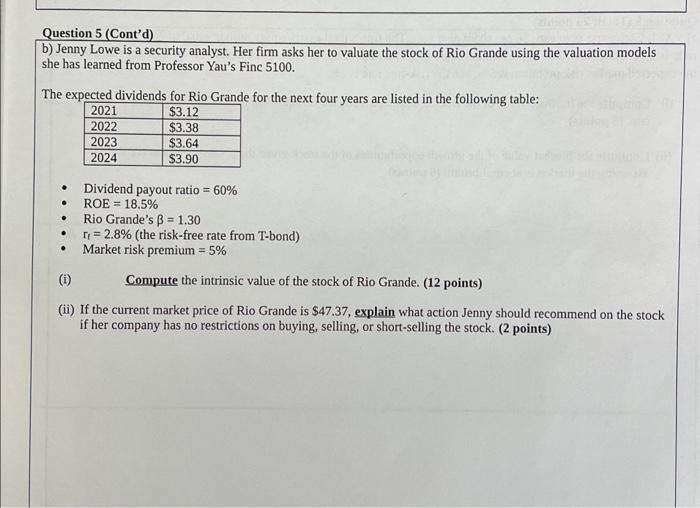

a. Explain what short selling is. (3 points) b. Contrast the open-end and closed-end funds. (4 points) c. Explain what the 12b-1 charge is. (3 points) d. Explain the relationship between a forward P/E and k. (Note: Showing the formula or equation would receive no credit) (4 points) e. The Closet Fund is a closed-end investment company with a portfolio currently worth $200 million. It has an outstanding loan of $2 million, accounts payable including accrued 12b1 charges of $1,500,000, accounts receivable $500,000, and 5 million shares outstanding. Compute the NAV of the fund. (5 points) Question 5 (Total: 25 points) a) VXEL Corp expects to earn $6 per share next year. The firm's total assets/equity ratio is equal to 2 , net profits/sales ratio is 0.015 , and sales/total assets ratio is equal to 5 , and its plowback ratio is to be kept at 60%. The firm's beta is 1.2 , the expected market risk premium is 5%, and the risk-free rate is 2%. (i) Compute the intrinsic value of the stock assuming the stock's earnings and dividends will grow at a constant rate, (5 points) (ii) Compute the present value of the growth opportunities of the stock given the results from part (i), and assuming the market is at equilibrium. (6 points) ) Jenny Lowe is a security analyst. Her firm asks her to valuate the stock of Rio Grande using the valuation models the has learned from Professor Yau's Finc 5100 . The expected dividends for Rio Grande for the next four years are listed in the following table: - Dividend payout ratio =60% - ROE=18.5% - Rio Grande's =1.30 - r1=2.8% (the risk-free rate from T-bond) - Market risk premium =5% (i) Compute the intrinsic value of the stock of Rio Grande. (12 points) (ii) If the current market price of Rio Grande is $47.37, explain what action Jenny should recommend on the stock if her company has no restrictions on buying, selling, or short-selling the stock. (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts