Question: ( a ) Explain why Instrumental Ltd is treated as being resident in the UK , and state what difference it would make if the

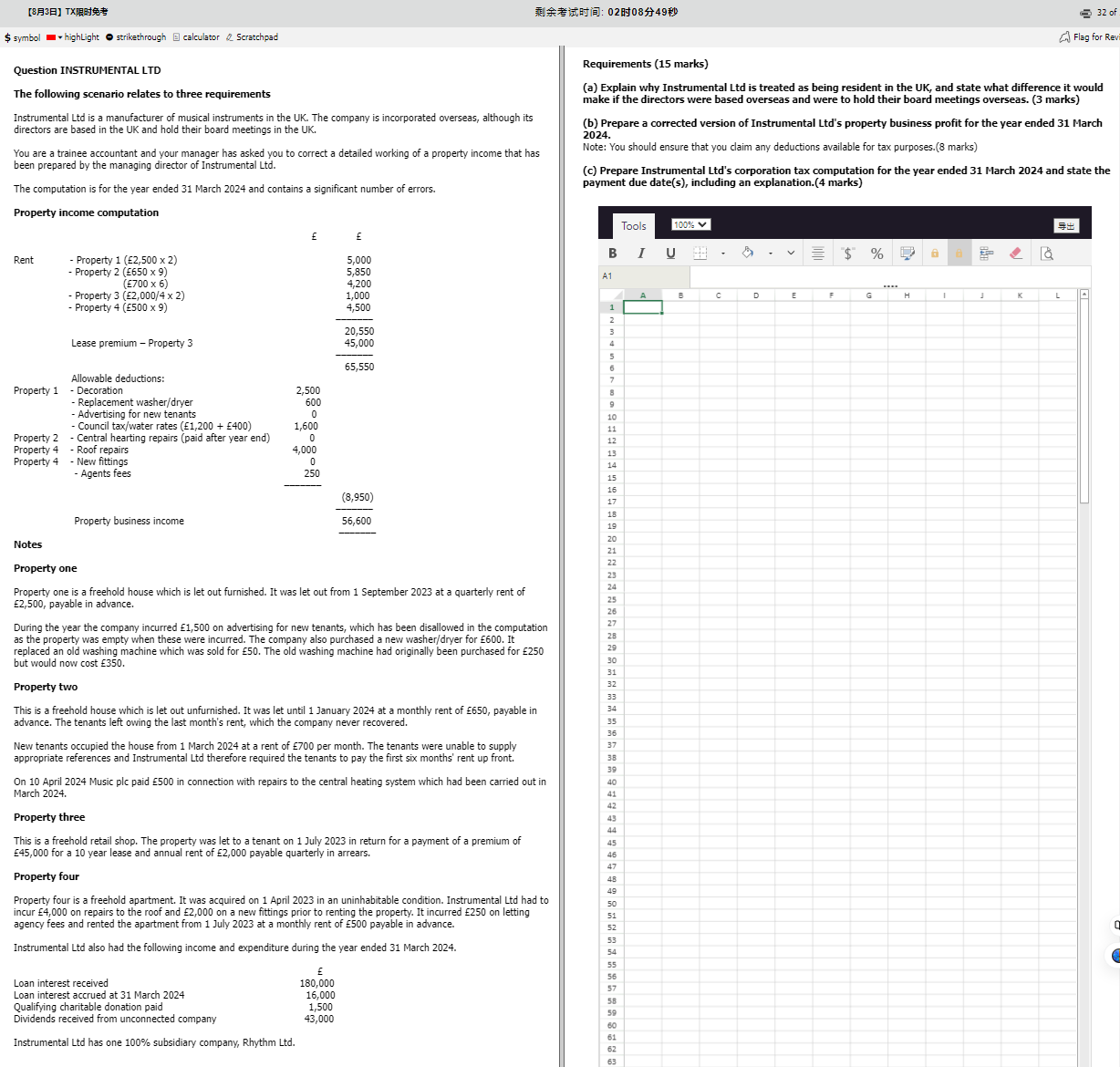

a Explain why Instrumental Ltd is treated as being resident in the UK and state what difference it would make if the directors were based overseas and were to hold their board meetings overseas. marks

b Prepare a corrected version of Instrumental Ltds property business profit for the year ended March

Note: You should ensure that you claim any deductions available for tax purposes. marks

c Prepare Instrumental Ltds corporation tax computation for the year ended March and state the payment due dates including an explanation. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock