Question: A father is now planning a savings program to put his daughter through college. She just celebrated her 1 3 th birthday, she plans to

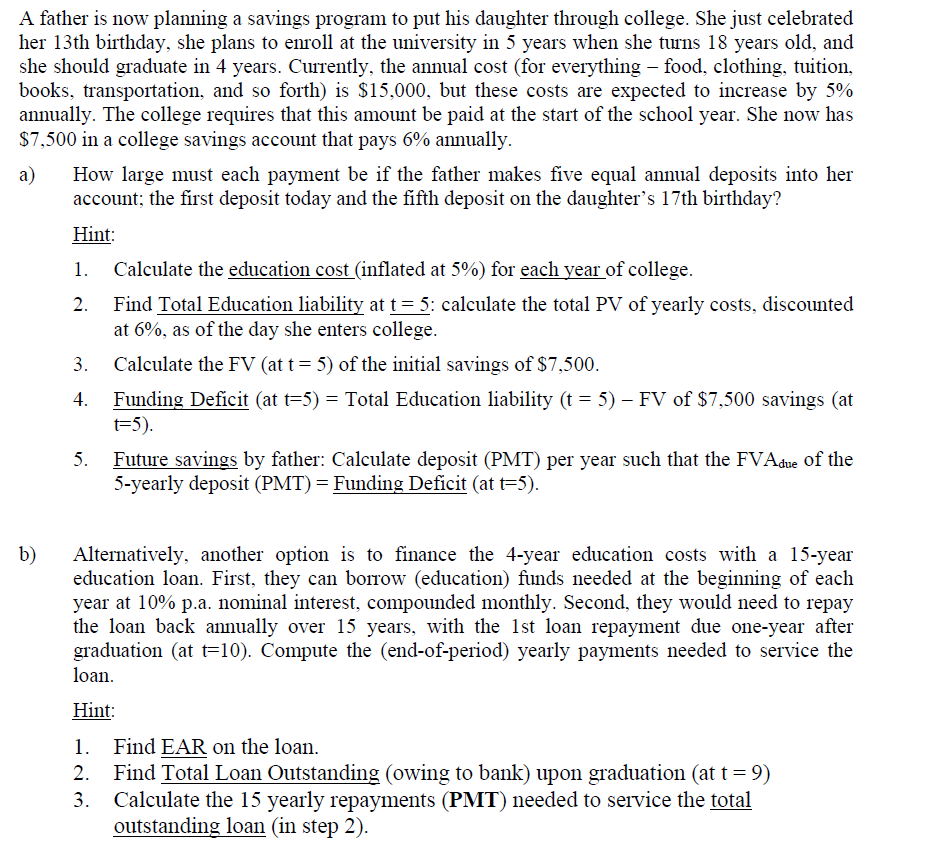

A father is now planning a savings program to put his daughter through college. She just celebrated

her th birthday, she plans to enroll at the university in years when she turns years old, and

she should graduate in years. Currently, the annual cost for everything food, clothing, tuition,

books, transportation, and so forth is $ but these costs are expected to increase by

annually. The college requires that this amount be paid at the start of the school year. She now has

$ in a college savings account that pays annually.

a How large must each payment be if the father makes five equal annual deposits into her

account; the first deposit today and the fifth deposit on the daughter's th birthday?

Hint:

Calculate the education cost inflated at for each year of college.

Find Total Education liability at : calculate the total PV of yearly costs, discounted

at as of the day she enters college.

Calculate the FV at of the initial savings of $

Funding Deficit at Total Education liability of $ savings at

Future savings by father: Calculate deposit PMT per year such that the of the

yearly deposit at

b Alternatively, another option is to finance the year education costs with a year

education loan. First, they can borrow education funds needed at the beginning of each

year at pa nominal interest, compounded monthly. Second, they would need to repay

the loan back annually over years, with the st loan repayment due oneyear after

graduation at Compute the endofperiod yearly payments needed to service the

loan.

Hint:

Find EAR on the loan.

Find Total Loan Outstanding owing to bank upon graduation at

Calculate the yearly repayments PMT needed to service the total

outstanding loan in step

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock