Question: A financial analyst would like to determine whether the return on Fidelitys Magellan mutual fund varies depending on the quarter; that is, if there is

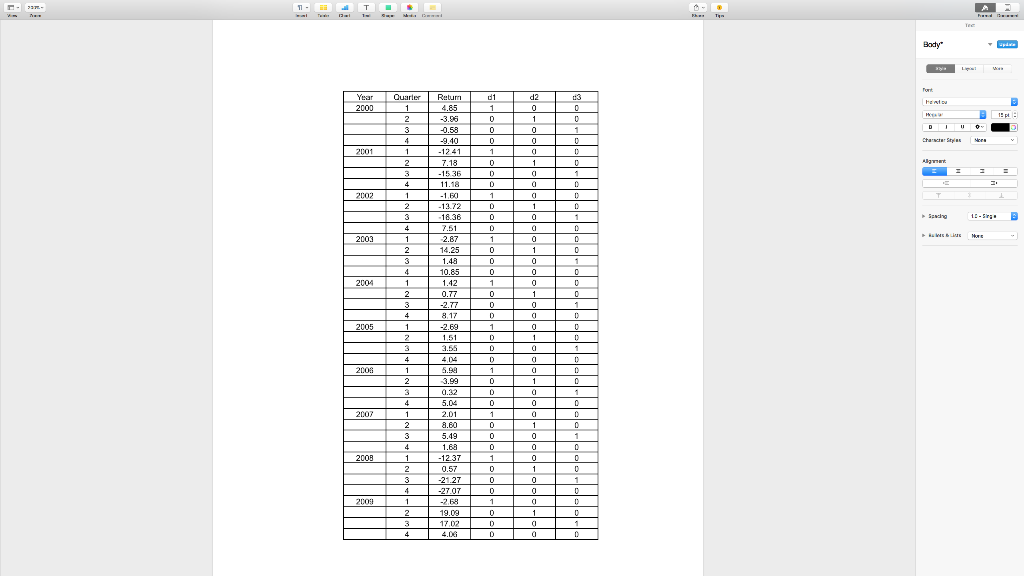

A financial analyst would like to determine whether the return on Fidelitys Magellan mutual fund varies depending on the quarter; that is, if there is a seasonal component describing return. He collects 10 years of quarterly return data. A portion is shown in the accompanying table.

a. Estimate y = 0 + 1d1 + 2d2 + 3d3 + , where y is Magellans quarterly return, d1 is a dummy variable that equals 1 if quarter 1 and 0 otherwise, d2 is a dummy variable that equals 1 if quarter 2 and 0 otherwise, and d3 is a dummy variable that equals 1 if quarter 3 and 0 otherwise. (Negative values should be indicated by a minus sign. Round your answers to 3 decimal places.)

b. Interpret the slope coefficients of the dummy variables.

-

Returns are predicted to be about 3.64% lower in quarter 1, compared to quarter 4.

-

Returns are predicted to be about 2.04% lower in quarter 1, compared to quarters 2, 3.

-

Returns are predicted to be about 3.64% lower in quarter 1, compared to quarters 2, 3.

-

Returns are predicted to be about 2.04% lower in quarter 1, compared to quarter 4.

c. Predict Magellans stock return in quarters 2 and 4. (Round coefficient estimates and final answer to 3 decimal places.)

Zoom Cuarter Reum SELLELE 89 Zoom Cuarter Reum SELLELE 89

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts