Question: a. Find the expected cash flow from each apartment complex. (Enter your answers in thousands (e.g, $10,000 should be enter as 10).) Expected Cash Flow

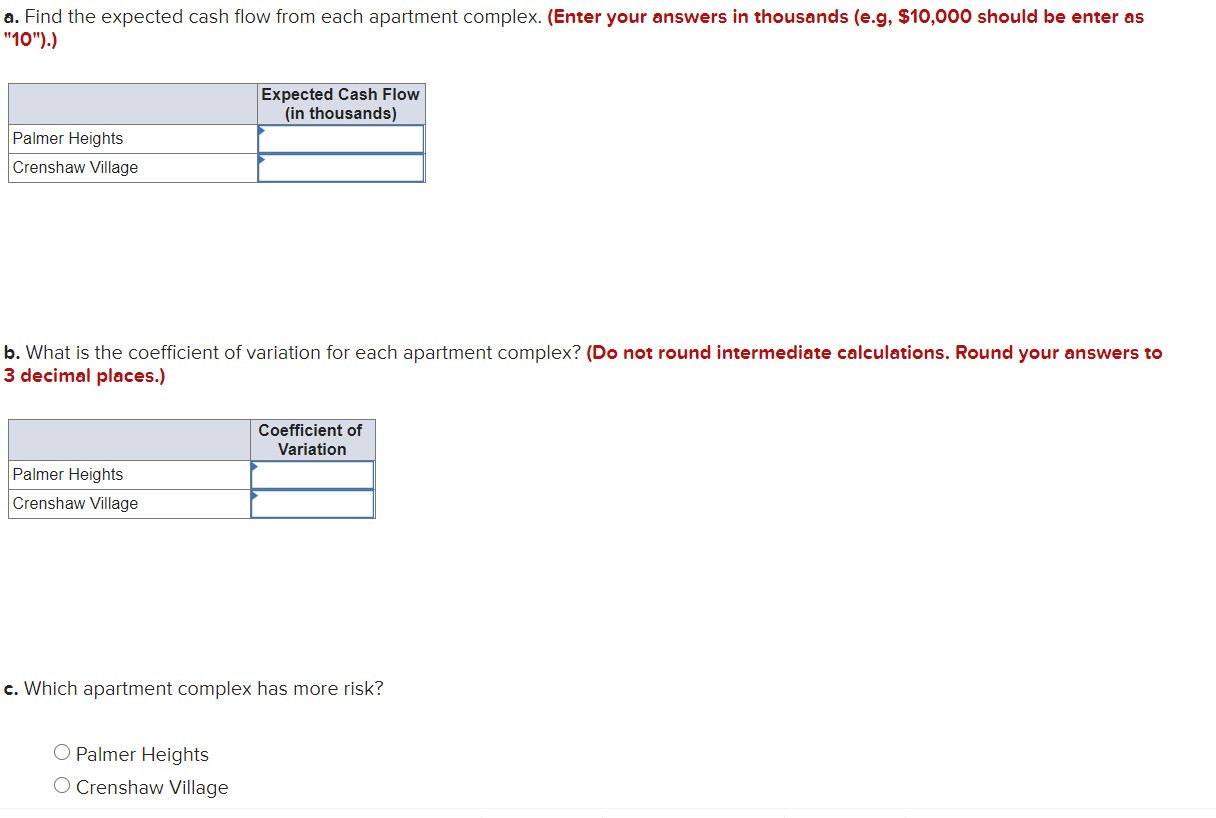

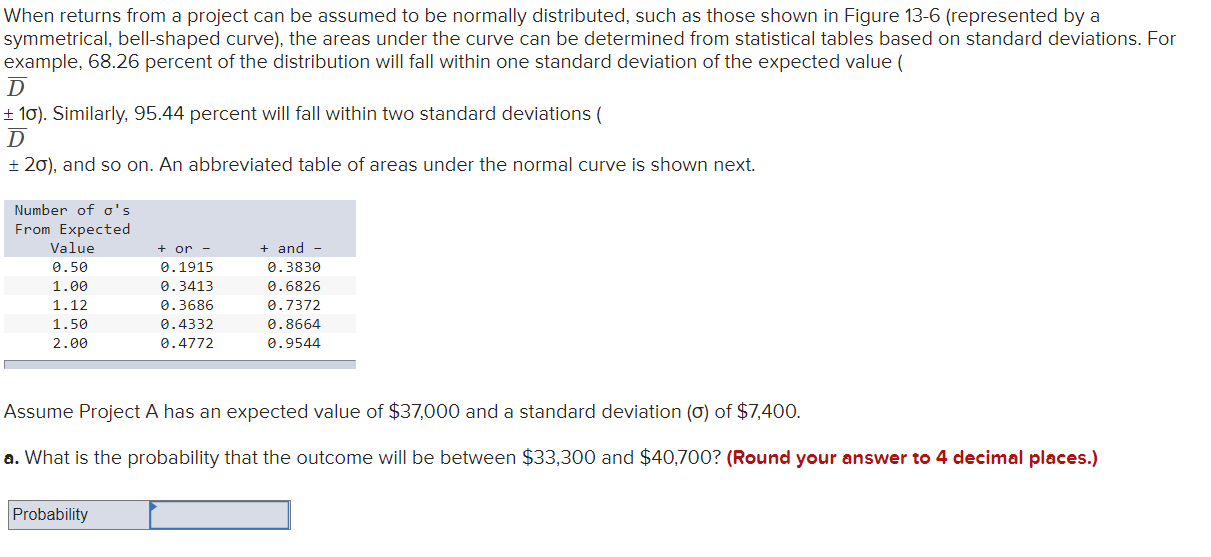

a. Find the expected cash flow from each apartment complex. (Enter your answers in thousands (e.g, $10,000 should be enter as "10").) Expected Cash Flow (in thousands) Palmer Heights Crenshaw Village b. What is the coefficient of variation for each apartment complex? (Do not round intermediate calculations. Round your answers to 3 decimal places.) Coefficient of Variation Palmer Heights Crenshaw Village c. Which apartment complex has more risk? O Palmer Heights O Crenshaw Village When returns from a project can be assumed to be normally distributed, such as those shown in Figure 13-6 (represented by a symmetrical, bell-shaped curve), the areas under the curve can be determined from statistical tables based on standard deviations. For example, 68.26 percent of the distribution will fall within one standard deviation of the expected value D + 10). Similarly, 95.44 percent will fall within two standard deviations ( D +20), and so on. An abbreviated table of areas under the normal curve is shown next. + or Number of o's From Expected Value 0.50 1.00 1.12 1.50 2.00 0.1915 0.3413 0.3686 0.4332 0.4772 + and - 0.3830 0.6826 0.7372 0.8664 0.9544 Assume Project A has an expected value of $37,000 and a standard deviation (0) of $7,400. a. What is the probability that the outcome will be between $33,300 and $40,700? (Round your answer to 4 decimal places.) Probability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts