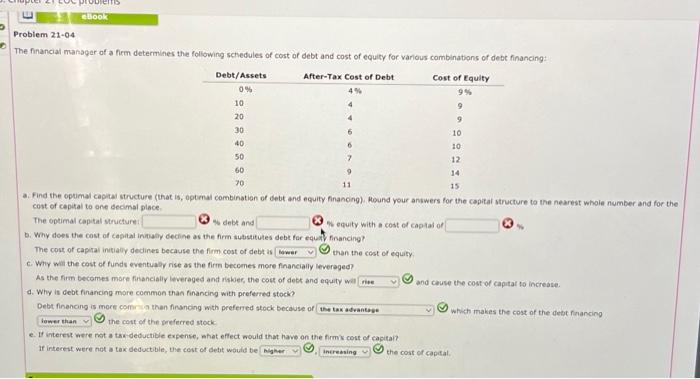

Question: a. Find the optimal capltal structure (that is, optimal combination of debt and equity financing) Pound your answers for the capital structure to the nearest

a. Find the optimal capltal structure (that is, optimal combination of debt and equity financing) Pound your answers for the capital structure to the nearest whoie number and for t cost of cepital to one decimal place. The optimal capital structure: (3) debs and b. Why does the cost of caphal infinaly cecine as the firm sutistitutes debe for equaty financing? The cost of capial initialy dedines because the firm cost of debt is than the cost of equity. c. Why wili the cost of funds eventualy rise as the firm becomes more financially leveraged? As the firm becomes more financially leveraged and risker, the cost of debt and equity wal a. Why is debt finaricing more common than financing with preferted stock? Debt finenang is more comnat than finsnoing with preferred stock becavse of Which makes the cost of the debt financing the cott of the preferred stock: e. If intereut were not a tas-deductible expense, shat effect nould that have on the firmi cost of capitai? If interest were not a tax deductible, ble cost of debt would be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts