Question: A firm does not pay a dividend. It is expected to pay its first dividend of $15.32 per share in five years. This dividend will

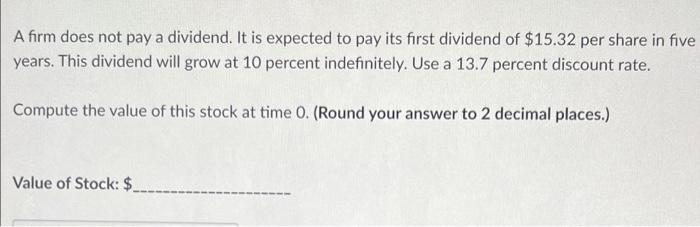

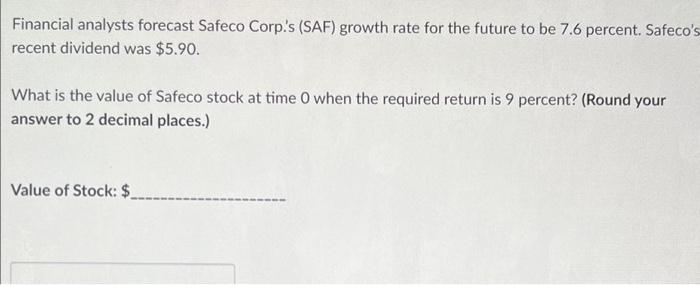

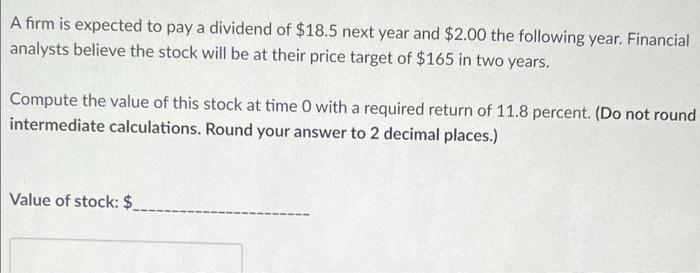

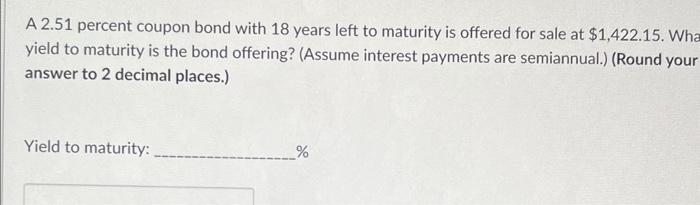

A firm does not pay a dividend. It is expected to pay its first dividend of $15.32 per share in five years. This dividend will grow at 10 percent indefinitely. Use a 13.7 percent discount rate. Compute the value of this stock at time 0. (Round your answer to 2 decimal places.) Value of Stock: $ Financial analysts forecast Safeco Corp's (SAF) growth rate for the future to be 7.6 percent. Safeco's recent dividend was $5.90. What is the value of Safeco stock at time 0 when the required return is 9 percent? (Round your answer to 2 decimal places.) Value of Stock: $ A firm is expected to pay a dividend of $18.5 next year and $2.00 the following year. Financial analysts believe the stock will be at their price target of $165 in two years. Compute the value of this stock at time 0 with a required return of 11.8 percent. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Value of stock: $ A 2.51 percent coupon bond with 18 years left to maturity is offered for sale at $1,422.15. Wha yield to maturity is the bond offering? (Assume interest payments are semiannual.) (Round your answer to 2 decimal places.) Yield to maturity: %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts