Question: A firm expanded its refining operations which required new petroleum refining equipment to be purchased for $675,000 in August 2015. The equipment was immediately put

A firm expanded its refining operations which required new petroleum refining equipment to be purchased for $675,000 in August 2015. The equipment was immediately put into service. Sales revenue for the year was $2,225,000. Operating expenses for the year, not including depreciation and capital expenditures, was $1,048,000.

a. If the equipment uses straight line depreciation, what is the value of depreciation in year 2015?

b. Assume the value of depreciation for year 2015 is $50,000. Calculate the net cash flow for year 2015 using an approximate corporate income tax rate of 40%.

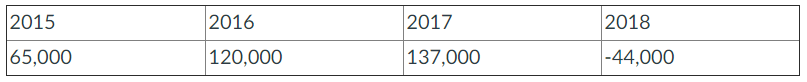

c. Given the following net cash flows, calculate the net present value of the project in year 2015. Assume the firm has a MARR of 10% per year.

2015 |2016 |2017 2018 |65,000 120,000 | 137,000 |-44,000 2015 |2016 |2017 2018 |65,000 120,000 | 137,000 |-44,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts