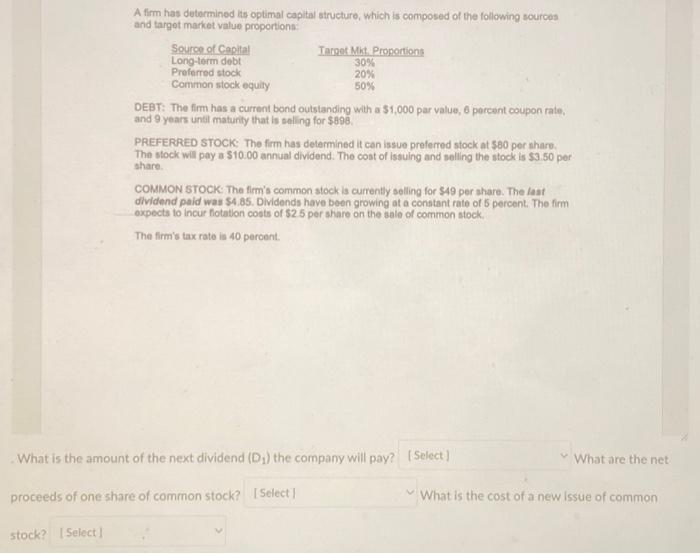

Question: A firm has determined its optimal capital structure, which is composed of the following sources and target market value proportions DEBT: The fim has a

A firm has determined its optimal capital structure, which is composed of the following sources and target market value proportions DEBT: The fim has a current bond outstanding with a $1,000 par value, 6 percent coupon rate. and 9 years unti maturily that is selling for $898 PREFERRED STOCK: The firm has delermined it can issue preferred stock at 580 per share The stock will pay a $10.00 annual dividend. The coat of issuing and selling the stock is $3.50 per share. COMMON STOCK: The firm's common stock is currently selling for $49 per share. The last dividend paid was \$4.85. Dividends have been growing at a constant rate of 5 percent. The firm expects to incur flotation costs of $2.5 per share on the sale of common stock. The firm's tax rate is 40 peroent. What is the amount of the next dividend (D1) the company will pay? What are the net proceeds of one share of common stock? What is the cost of a new issue of common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts