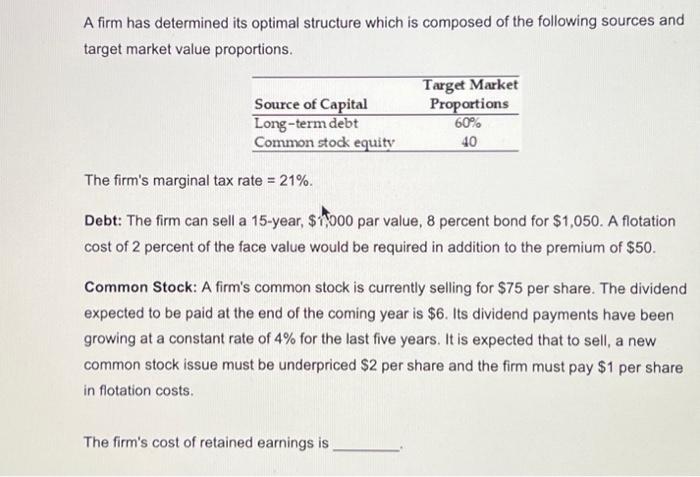

Question: A firm has determined its optimal structure which is composed of the following sources and target market value proportions. The firm's marginal tax rate =21%.

A firm has determined its optimal structure which is composed of the following sources and target market value proportions. The firm's marginal tax rate =21%. Debt: The firm can sell a 15 -year, $1,000 par value, 8 percent bond for $1,050. A flotation cost of 2 percent of the face value would be required in addition to the premium of $50. Common Stock: A firm's common stock is currently selling for $75 per share. The dividend expected to be paid at the end of the coming year is $6. Its dividend payments have been growing at a constant rate of 4% for the last five years. It is expected that to sell, a new common stock issue must be underpriced $2 per share and the firm must pay $1 per share in flotation costs. The firm's cost of retained earnings is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts