Question: A firm is analyzing a potential project that will require an initial investment of $30,000 and after-tax operating cash inflows of $12,000 per year

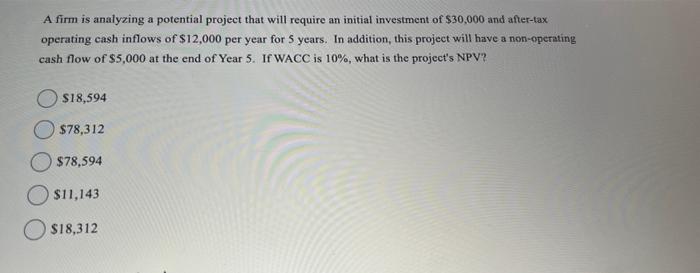

A firm is analyzing a potential project that will require an initial investment of $30,000 and after-tax operating cash inflows of $12,000 per year for 5 years. In addition, this project will have a non-operating cash flow of $5,000 at the end of Year 5. If WACC is 10%, what is the project's NPV? $18,594 $78,312 $78,594 $11,143 $18,312

Step by Step Solution

3.53 Rating (156 Votes )

There are 3 Steps involved in it

NP V 30 000 12 000 1 0 1 12 000 1 0 1 2 12 000 1 0 ... View full answer

Get step-by-step solutions from verified subject matter experts