Question: A firm is considering a new project whose risk is greater than the risk of the firm's average project, based on all methods for assessing

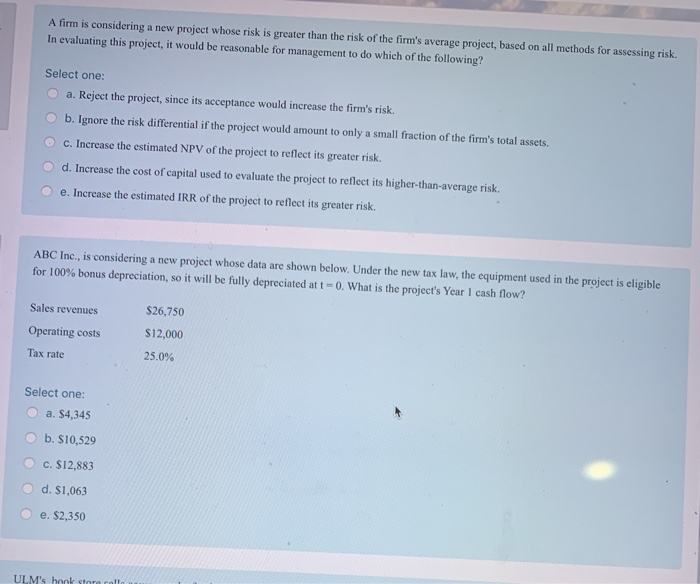

A firm is considering a new project whose risk is greater than the risk of the firm's average project, based on all methods for assessing risk. In evaluating this project, it would be reasonable for management to do which of the following? Select one: a. Reject the project, since its acceptance would increase the firm's risk. b. Ignore the risk differential if the project would amount to only a small fraction of the firm's total assets. C. Increase the estimated NPV of the project to reflect its greater risk. d. Increase the cost of capital used to evaluate the project to reflect its higher-than-average risk. e. Increase the estimated IRR of the project to reflect its greater risk, ABC Inc., is considering a new project whose data are shown below. Under the new tax law, the equipment used in the project is eligible for 100% bonus depreciation, so it will be fully depreciated at t = 0. What is the project's Year I cash flow? $26,750 Sales revenues Operating costs Tax rate $12,000 25.0% Select one: a. S4,345 b. $10,529 C. $12,883 d. $1,063 e. $2,350 ULM's hook stor roll

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts