Question: A firm is considering a project that requires an initial outlay of $2.5 million and will generate $400,000 in incremental, after-tax cash flows for ten

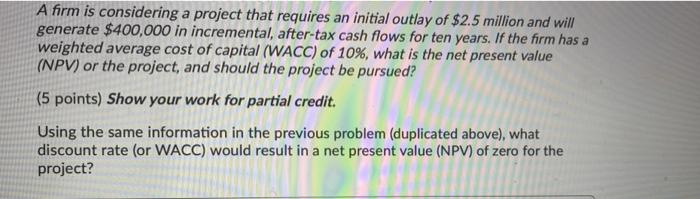

A firm is considering a project that requires an initial outlay of $2.5 million and will generate $400,000 in incremental, after-tax cash flows for ten years. If the firm has a weighted average cost of capital (WACC) of 10%, what is the net present value (NPV) or the project, and should the project be pursued? (5 points) Show your work for partial credit. Using the same information in the previous problem (duplicated above), what discount rate (or WACC) would result in a net present value (NPV) of zero for the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts