Question: A firm is considering a project with a five-year life and an initial cost of $120,000. It expects to sell 2,100 units a year at

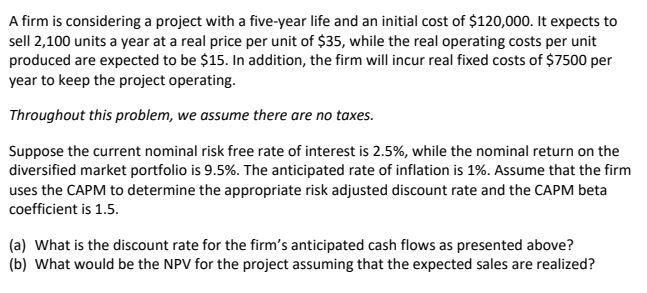

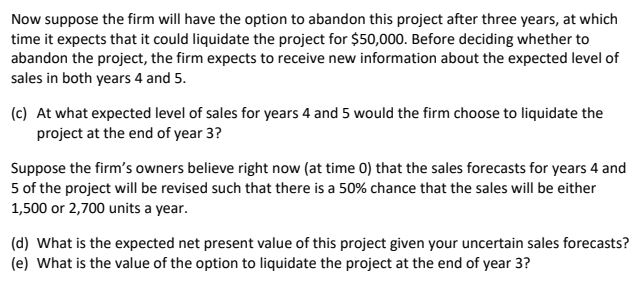

A firm is considering a project with a five-year life and an initial cost of $120,000. It expects to sell 2,100 units a year at a real price per unit of $35, while the real operating costs per unit produced are expected to be $15. In addition, the firm will incur real fixed costs of $7500 per year to keep the project operating. Throughout this problem, we assume there are no taxes. Suppose the current nominal risk free rate of interest is 2.5%, while the nominal return on the diversified market portfolio is 9.5%. The anticipated rate of inflation is 1%. Assume that the firm uses the CAPM to determine the appropriate risk adjusted discount rate and the CAPM beta coefficient is 1.5. (a) What is the discount rate for the firm's anticipated cash flows as presented above? (b) What would be the NPV for the project assuming that the expected sales are realized? Now suppose the firm will have the option to abandon this project after three years, at which time it expects that it could liquidate the project for $50,000. Before deciding whether to abandon the project, the firm expects to receive new information about the expected level of sales in both years 4 and 5. (c) At what expected level of sales for years 4 and 5 would the firm choose to liquidate the project at the end of year 3? Suppose the firm's owners believe right now (at time 0) that the sales forecasts for years 4 and 5 of the project will be revised such that there is a 50% chance that the sales will be either 1,500 or 2,700 units a year. (d) What is the expected net present value of this project given your uncertain sales forecasts? (e) What is the value of the option to liquidate the project at the end of year 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts