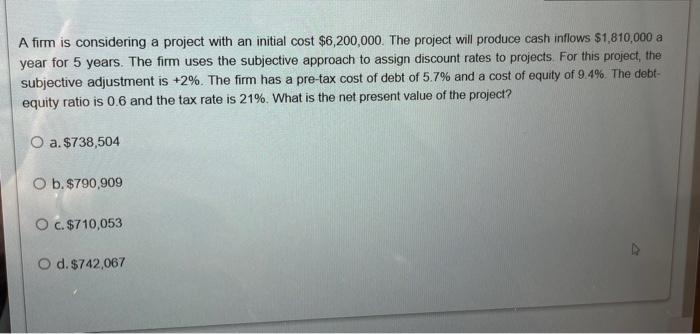

Question: A firm is considering a project with an initial cost $6,200,000. The project will produce cash inflows $1,810,000 a year for 5 years. The

A firm is considering a project with an initial cost $6,200,000. The project will produce cash inflows $1,810,000 a year for 5 years. The firm uses the subjective approach to assign discount rates to projects. For this project, the subjective adjustment is +2%. The firm has a pre-tax cost of debt of 5.7% and a cost of equity of 9.4%. The debt- equity ratio is 0.6 and the tax rate is 21%. What is the net present value of the project? O a. $738,504 O b. $790,909 O c. $710,053 O d. $742,067

Step by Step Solution

There are 3 Steps involved in it

The detailed answer for the above question is provided below To calculate the net present value NPV of the project we need to discount the expected ca... View full answer

Get step-by-step solutions from verified subject matter experts