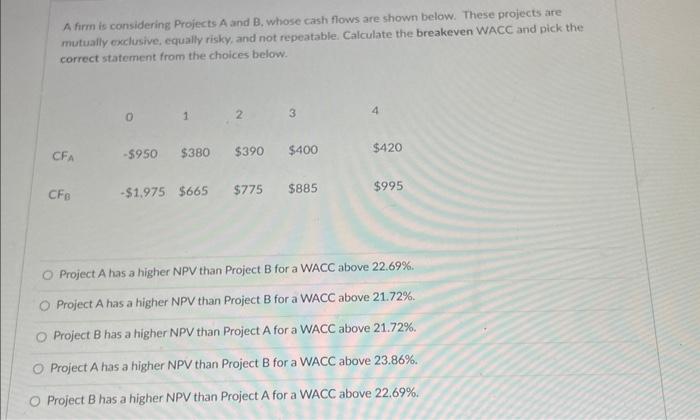

Question: A firm is considering Projects A and B, whose cash flows are shown below. These projects are muluafly cxctuslve, cqually risky and not repeatable. Calculate

A firm is considering Projects A and B, whose cash flows are shown below. These projects are muluafly cxctuslve, cqually risky and not repeatable. Calculate the breakeven WACC and pick the correct statement from the choices below. Project A has a higher NPV than Project B for a WACC above 22.69%. Project A has a higher NPV than Project B for a WACC above 21.72%. Project B has a higher NPV than Project A for a WACC above 21.72%. Project A has a higher NPV than Project B for a WACC above 23.86%. Project B has a higher NPV than Project A for a WACC above 22.69%. A firm is considering Projects A and B, whose cash flows are shown below. These projects are muluafly cxctuslve, cqually risky and not repeatable. Calculate the breakeven WACC and pick the correct statement from the choices below. Project A has a higher NPV than Project B for a WACC above 22.69%. Project A has a higher NPV than Project B for a WACC above 21.72%. Project B has a higher NPV than Project A for a WACC above 21.72%. Project A has a higher NPV than Project B for a WACC above 23.86%. Project B has a higher NPV than Project A for a WACC above 22.69%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts