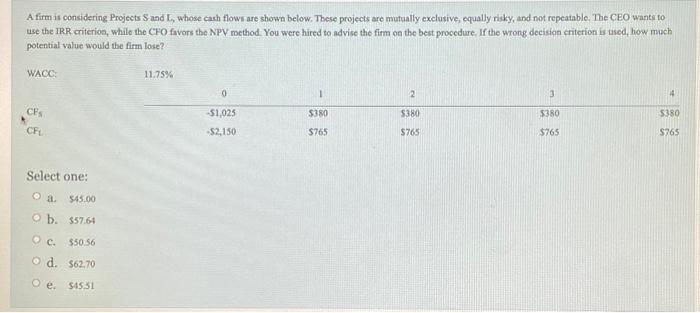

Question: A firm is considering Projects Sand L, whose cash flow are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO

A firm is considering Projects Sand L, whose cash flow are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO wants to use the IRR criterion, while the CFO favors the NPV method. You were hired to advise the firm on the best procedure. If the wrong decision criterion is used, how much potential value would the firm lose? WACC 11.75% 0 1 2 3 4 CES $380 $380 5380 5380 51,025 52,150 CE $765 $765 $765 S765 Select one: a $45.00 b. 357.64 . d. 562.70 $50.56 e. S4531

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts