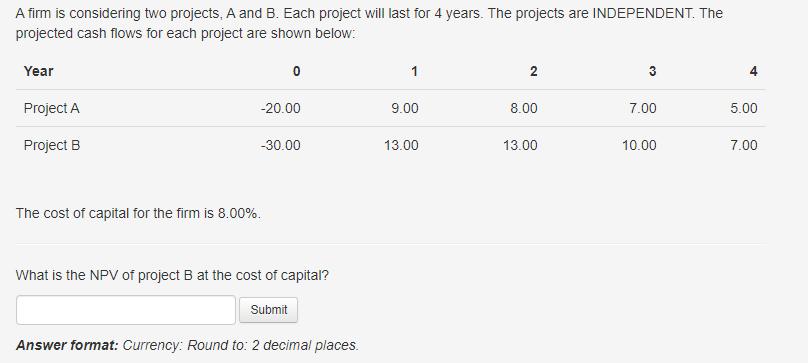

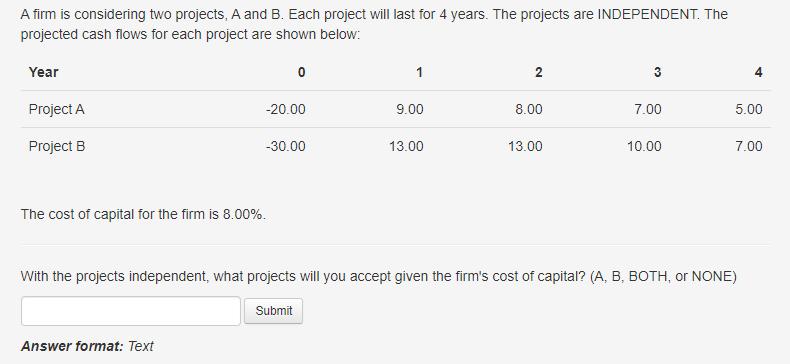

Question: A firm is considering two projects, A and B. Each project will last for 4 years. The projects are INDEPENDENT. The projected cash flows

A firm is considering two projects, A and B. Each project will last for 4 years. The projects are INDEPENDENT. The projected cash flows for each project are shown below: Year Project A Project B 0 -20.00 -30.00 The cost of capital for the firm is 8.00%. What is the NPV of project B at the cost of capital? Submit Answer format: Currency: Round to: 2 decimal places. 9.00 13.00 2 8.00 13.00 3 7.00 10.00 5.00 7.00 A firm is considering two projects, A and B. Each project will last for 4 years. The projects are INDEPENDENT. The projected cash flows for each project are shown below: Year Project A Project B 0 -20.00 The cost of capital for the firm is 8.00%. Answer format: Text -30.00 1 9.00 13.00 2 8.00 13.00 7.00 10.00 5.00 7.00 With the projects independent, what projects will you accept given the firm's cost of capital? (A, B, BOTH, or NONE) Submit

Step by Step Solution

3.62 Rating (156 Votes )

There are 3 Steps involved in it

1 NPV of Project B 30 13 1081 13 1082 10 ... View full answer

Get step-by-step solutions from verified subject matter experts