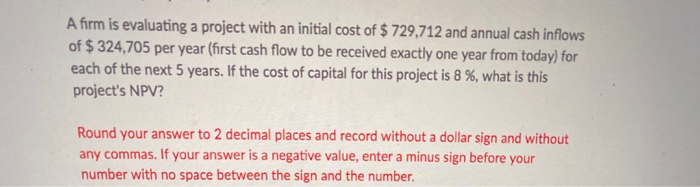

Question: A firm is evaluating a project with an initial cost of $ 729,712 and annual cash inflows of $ 324,705 per year (first cash flow

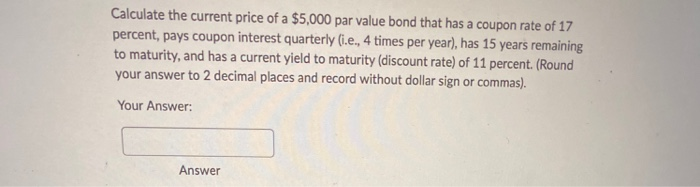

A firm is evaluating a project with an initial cost of $ 729,712 and annual cash inflows of $ 324,705 per year (first cash flow to be received exactly one year from today) for each of the next 5 years. If the cost of capital for this project is 8 %, what is this project's NPV? Round your answer to 2 decimal places and record without a dollar sign and without any commas. If your answer is a negative value, enter a minus sign before your number with no space between the sign and the number. Calculate the current price of a $5,000 par value bond that has a coupon rate of 17 percent, pays coupon interest quarterly (.e., 4 times per year), has 15 years remaining to maturity, and has a current yield to maturity (discount rate) of 11 percent. (Round your answer to 2 decimal places and record without dollar sign or commas). Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts