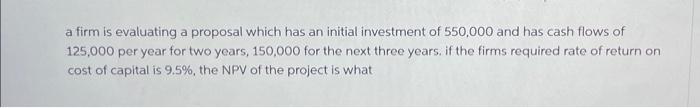

Question: a firm is evaluating a proposal which has an initial investment of 550,000 and has cash flows of 125,000 per year for two years, 150,000

a firm is evaluating a proposal which has an initial investment of 550,000 and has cash flows of 125,000 per year for two years, 150,000 for the next three years. if the firms required rate of return on cost of capital is 9.5%, the NPV of the project is what

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts