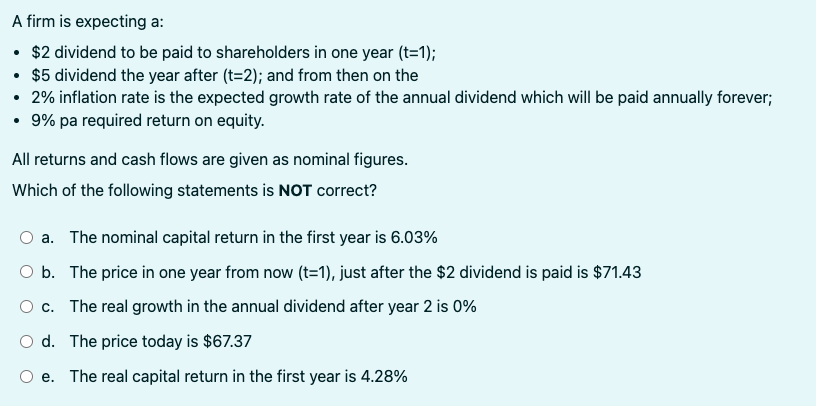

Question: A firm is expecting a : - $2 dividend to be paid to shareholders in one year (t=1); - $5 dividend the year after (t=2);

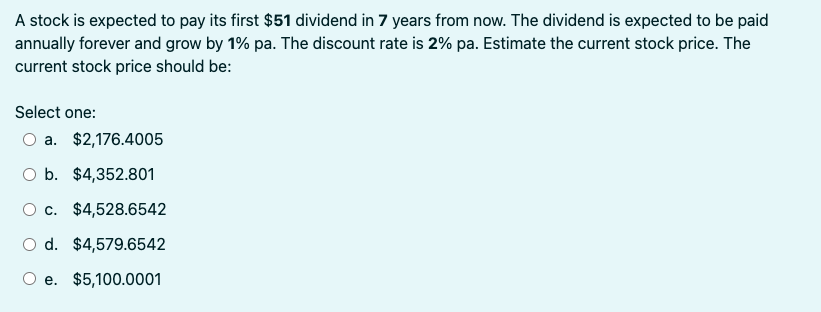

A firm is expecting a : - $2 dividend to be paid to shareholders in one year (t=1); - $5 dividend the year after (t=2); and from then on the - 2% inflation rate is the expected growth rate of the annual dividend which will be paid annually forever; - 9% pa required return on equity. All returns and cash flows are given as nominal figures. Which of the following statements is NOT correct? a. The nominal capital return in the first year is 6.03% b. The price in one year from now (t=1 ), just after the $2 dividend is paid is $71.43 c. The real growth in the annual dividend after year 2 is 0% d. The price today is $67.37 e. The real capital return in the first year is 4.28% A stock is expected to pay its first $51 dividend in 7 years from now. The dividend is expected to be paid annually forever and grow by 1% pa. The discount rate is 2% pa. Estimate the current stock price. The current stock price should be: Select one: a. $2,176.4005 b. $4,352.801 c. $4,528.6542 d. $4,579.6542 e. $5,100.0001

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts