Question: A firm is to choose between two mutually exclusive projects. Suppose there are two possible states in the future: one is economy boom with a

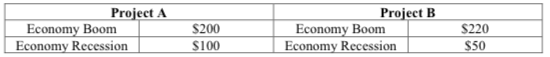

A firm is to choose between two mutually exclusive projects. Suppose there are two possible states in the future: one is economy boom with a probability of 40% and the other is economy recession with a probability of 60%. If the payoff schedule of these two projects is the following:

A) Suppose you own this firm, and you finance this firm all with your own money, which project will you undertake? Please state the expected payoff of each project. (hint: you want to maximize the expected value of this project)

B) Suppose you still own this firm. But you finance your firm with $100 debt. If you want to maximize the payoff to you (not to both you and the debt holder), which project will you undertake? Please state the expected payoff of each project to you.

C) What problem of debt contract is shown by the above example? (One type of Moral Hazard problems. I am looking for a two-word answer).

Project A Project B Economy Boom Economy Recession $200 S100 Economy Boom Economy Recession S220 S50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts