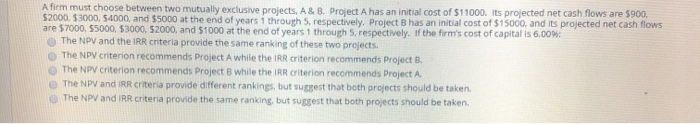

Question: A firm must choose between two mutually exclusive projects, A & B. Project A has an initial cost of $11000. Its projected net cash flows

A firm must choose between two mutually exclusive projects, A & B. Project A has an initial cost of $11000. Its projected net cash flows are $900. 52000 53000, $4000, and $5000 at the end of years 1 through 5. respectively. Project B has an initial cost of $15000, and its projected net cash flows are 57000 55000, 53000, 52000, and 51000 at the end of years 1 through 5, respectively. If the firm's cost of capital is 6.00% The NPV and the IRR criteria provide the same ranking of these two projects. The NPV criterion recommends Project A while the IRR criterion recommends Project B. The NPV criterion recommends Project while the IRR criterion recommends Project A The NPV and IRR Criteria provide different rankings, but sugest that both projects should be taken The NPV and IRR criteria provide the same ranking, but suggest that both projects should be taken

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts