Question: A firm needs to obtain a specialized machine, which would cost $5600 to buy. It would be depreciated at the rate of $560 per

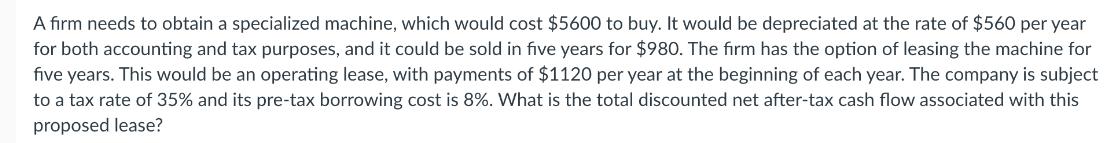

A firm needs to obtain a specialized machine, which would cost $5600 to buy. It would be depreciated at the rate of $560 per year for both accounting and tax purposes, and it could be sold in five years for $980. The firm has the option of leasing the machine for five years. This would be an operating lease, with payments of $1120 per year at the beginning of each year. The company is subject to a tax rate of 35% and its pre-tax borrowing cost is 8%. What is the total discounted net after-tax cash flow associated with this proposed lease?

Step by Step Solution

There are 3 Steps involved in it

To calculate the total discounted net aftertax cash flow associated with the proposed lease we need to compare the cash flows from buying the machine ... View full answer

Get step-by-step solutions from verified subject matter experts