A firm pays a $1.50 dividend at the end of year one (0). has a stock...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

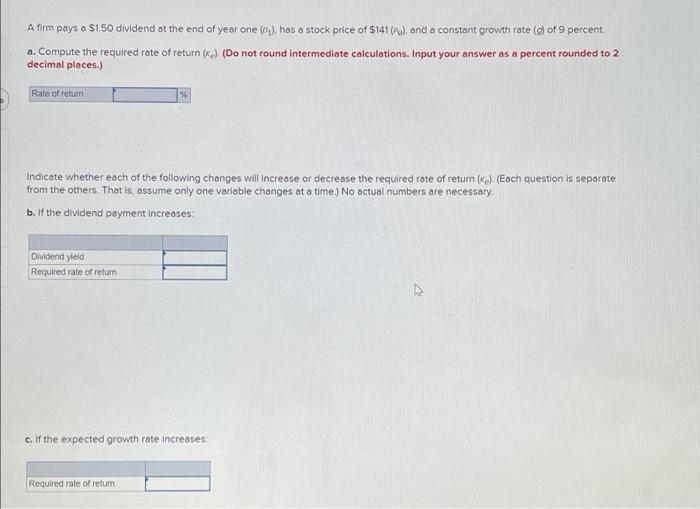

A firm pays a $1.50 dividend at the end of year one (0₁). has a stock price of $141 (Pa), and a constant growth rate (g) of 9 percent. a. Compute the required rate of return (ke). (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Rate of return Indicate whether each of the following changes will increase or decrease the required rate of return (ke). (Each question is separate from the others. That is, assume only one variable changes at a time.) No actual numbers are necessary. b. If the dividend payment increases: Dividend yield Required rate of return c. If the expected growth rate increases: Required rate of return A firm pays a $1.50 dividend at the end of year one (0₁). has a stock price of $141 (Pa), and a constant growth rate (g) of 9 percent. a. Compute the required rate of return (ke). (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Rate of return Indicate whether each of the following changes will increase or decrease the required rate of return (ke). (Each question is separate from the others. That is, assume only one variable changes at a time.) No actual numbers are necessary. b. If the dividend payment increases: Dividend yield Required rate of return c. If the expected growth rate increases: Required rate of return

Expert Answer:

Answer rating: 100% (QA)

In the above given question it is given that stock price Po 141 Divide... View the full answer

Related Book For

Foundations of Financial Management

ISBN: 978-1259194078

15th edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen

Posted Date:

Students also viewed these accounting questions

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

Is the process for issuing a standard sufficient to ensure that all interested parties are consulted? What are the benefits and potential limitations of the process?

-

What occurs when a business pledges its receivables?

-

A customer walks into the store, and a sales representative welcomes the customer. The customer arrives at the cash register and places the items on the counter. The cashier asks for the customer s...

-

The probability that the noise level of a wide-band amplifier will exceed \(2 \mathrm{~dB}\) is 0.05. Use Table 1 or software to find the probabilities that among 12 such amplifiers the noise level...

-

Med-Tech labs is a facility that provides medical tests and evaluations for patients, ranging from analyzing blood samples to performing magnetic resonance imaging (MRI). Average cost to patients is...

-

-What kind of the four retailing concepts from the four (customer orientation, coordinator effort, value driven, and goal orientation) does Ulta Beauty uses? -Identify how the retailer develops its...

-

John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In 2020, John worked as a computer technician at a local university earning a salary of $152,000, and...

-

Make a Java class that contains data and methods for a ship. Call this class Ship followed by your initial for your first and last name. (for example: if your name is Schinnel Small, the name of your...

-

Select a service brand you consider to be outstanding. Explain why you think it is outstanding. Also explore any weaknesses of this brand. You should select an organization you are familiar with.

-

Why are standards necessary to control the process of updating a website? Give three examples of different aspects of a website that need to be controlled.

-

Choose an industry you are familiar with (such as cell phone services, credit cards, or music streaming) and create a perceptual map showing the competitive positions of different service providers...

-

You have been appointed manager of a website for a car manufacturer and have been asked to refine the existing online measurement and improvement programme. Explain, in detail, the steps you would...

-

Most companies collect data about digital marketing activities, but few derive much value from it. Discuss possible reasons for this assertion.

-

Is using the Data Encryption Standard (DES) encryption algorithm a good idea to be used for encrypting our programs? If not, what are some of the alternative encryption algorithms to be used in...

-

A new car sold for $31,000. If the vehicle loses 15% of its value each year, how much will it be worth after 10 years?

-

The treasurer for Pittsburgh Iron Works wishes to use financial futures to hedge her interest rate exposure. She will sell five Treasury futures contracts at $138,000 per contract. It is July and the...

-

What are the differences between a call option and a put option?

-

Assume the following data for Cable Corporation and Multi-Media Inc. a. Compute return on stockholders equity for both firms using ratio 3a. Which firm has the higher return? b. Compute the following...

-

Give an example of a requirement on a computer printer.

-

Briefly describe the distinction between requirements and specification.

-

Give an example of a requirement on a digital still camera.

Study smarter with the SolutionInn App