Question: A firm was advised that it need to raise additional capital of $500m to put a dent in the unfulfilled demand from customers. The company

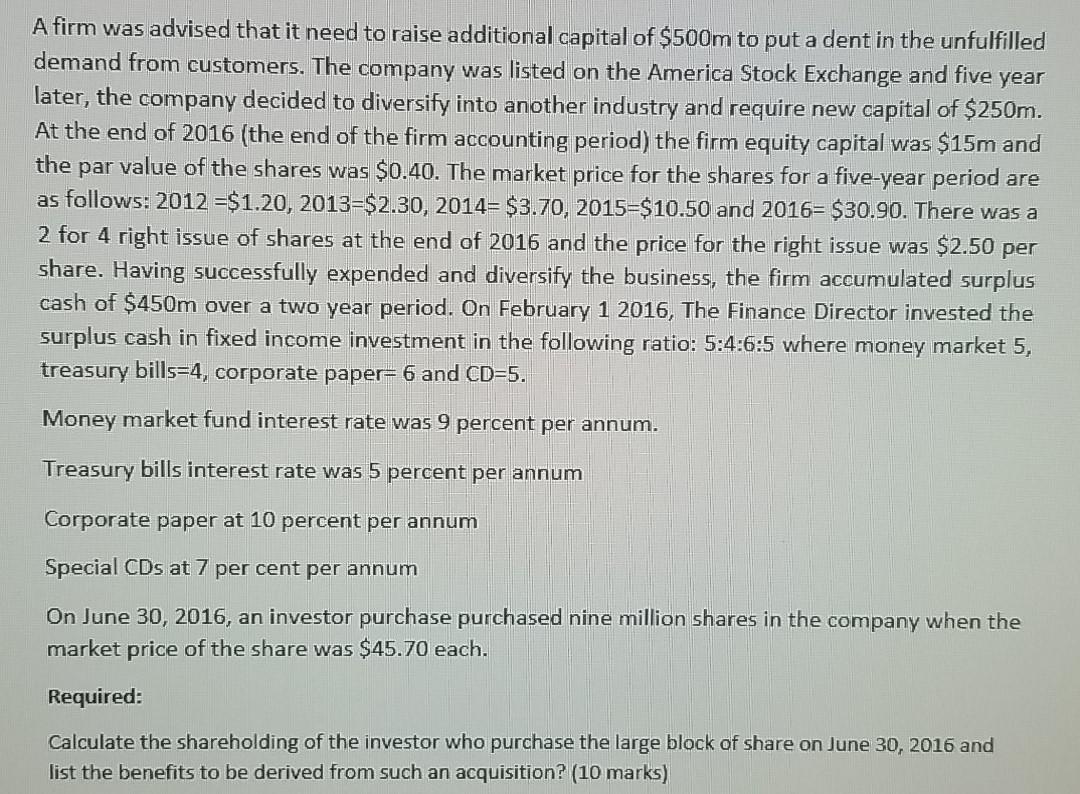

A firm was advised that it need to raise additional capital of $500m to put a dent in the unfulfilled demand from customers. The company was listed on the America Stock Exchange and five year later, the company decided to diversify into another industry and require new capital of $250m. At the end of 2016 (the end of the firm accounting period) the firm equity capital was $15m and the par value of the shares was $0.40. The market price for the shares for a five-year period are as follows: 2012 =$1.20, 2013=$2.30, 2014= $3.70, 2015=$10.50 and 2016= $30.90. There was a 2 for 4 right issue of shares at the end of 2016 and the price for the right issue was $2.50 per share. Having successfully expended and diversify the business, the firm accumulated surplus cash of $450m over a two year period. On February 1 2016, The Finance Director invested the surplus cash in fixed income investment in the following ratio: 5:4:6:5 where money market 5, treasury bills=4, corporate paper-6 and CD=5. Money market fund interest rate was 9 percent per annum. Treasury bills interest rate was 5 percent per annum Corporate paper at 10 percent per annum Special CDs at 7 per cent per annum On June 30, 2016, an investor purchase purchased nine million shares in the company when the market price of the share was $45.70 each. Required: Calculate the shareholding of the investor who purchase the large block of share on June 30, 2016 and list the benefits to be derived from such an acquisition? (10 marks) A firm was advised that it need to raise additional capital of $500m to put a dent in the unfulfilled demand from customers. The company was listed on the America Stock Exchange and five year later, the company decided to diversify into another industry and require new capital of $250m. At the end of 2016 (the end of the firm accounting period) the firm equity capital was $15m and the par value of the shares was $0.40. The market price for the shares for a five-year period are as follows: 2012 =$1.20, 2013=$2.30, 2014= $3.70, 2015=$10.50 and 2016= $30.90. There was a 2 for 4 right issue of shares at the end of 2016 and the price for the right issue was $2.50 per share. Having successfully expended and diversify the business, the firm accumulated surplus cash of $450m over a two year period. On February 1 2016, The Finance Director invested the surplus cash in fixed income investment in the following ratio: 5:4:6:5 where money market 5, treasury bills=4, corporate paper-6 and CD=5. Money market fund interest rate was 9 percent per annum. Treasury bills interest rate was 5 percent per annum Corporate paper at 10 percent per annum Special CDs at 7 per cent per annum On June 30, 2016, an investor purchase purchased nine million shares in the company when the market price of the share was $45.70 each. Required: Calculate the shareholding of the investor who purchase the large block of share on June 30, 2016 and list the benefits to be derived from such an acquisition? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts